- What is the yield curve?

- What does it suggest when it's inverted?

- What is yield curve control (YCC)?

- And how does the eurodollar fit into all this?

Inspirational Tweet:

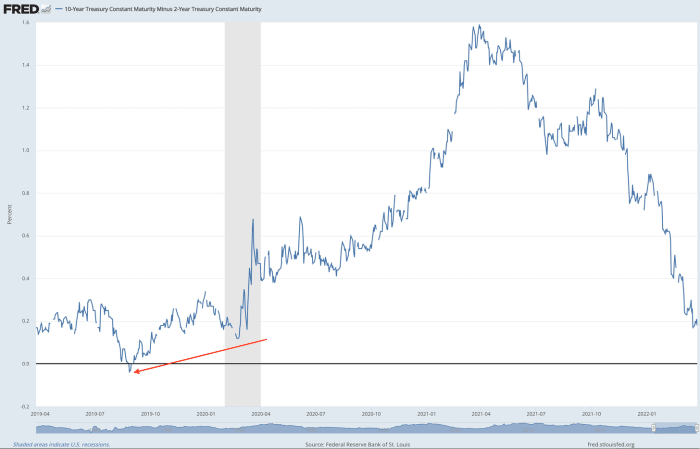

As Lyn Alden describes in this thread: "... the 10 -2 curve is stating, 'we're most likely getting near to a possible economic downturn, however not validated, and most likely numerous months away ...'"

Let's break that down a bit, shall we?

What Is The Yield Curve?

First of all, just what is the yield curve that everybody appears to be speaking about recently, and how is it connected to inflation, the Federal Reserve Board and possible economic downturn?

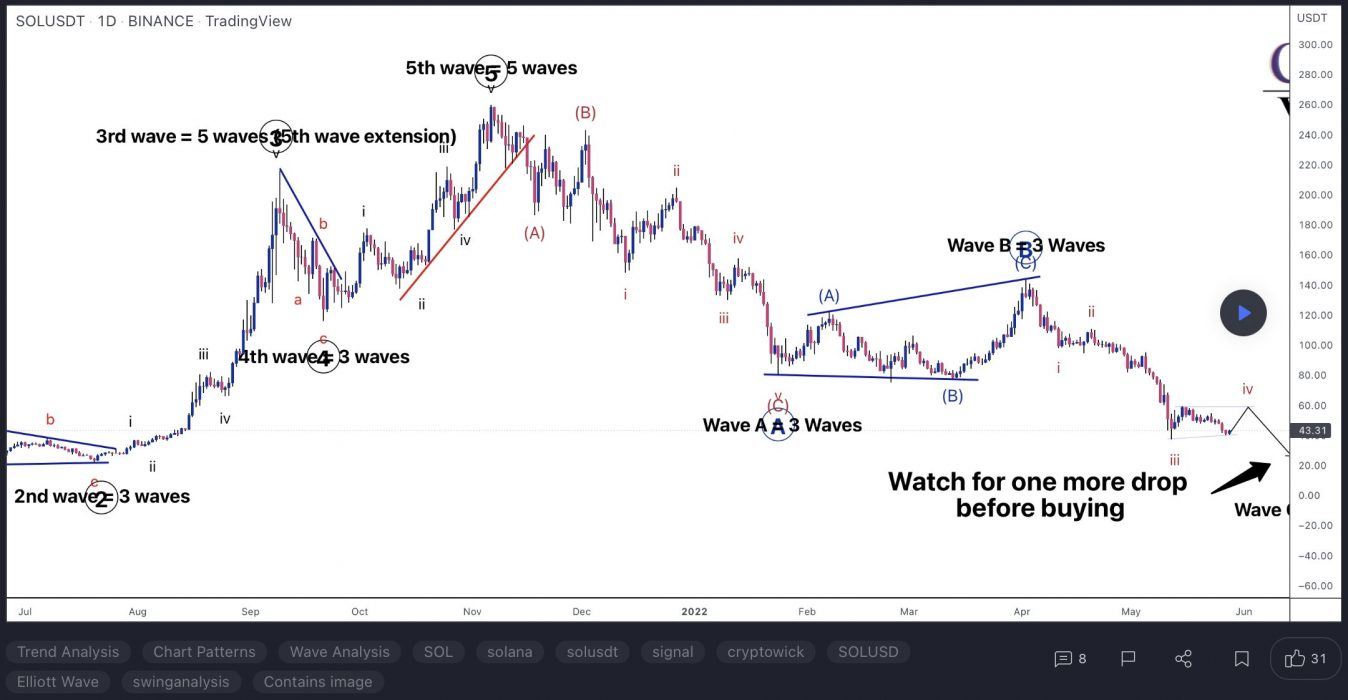

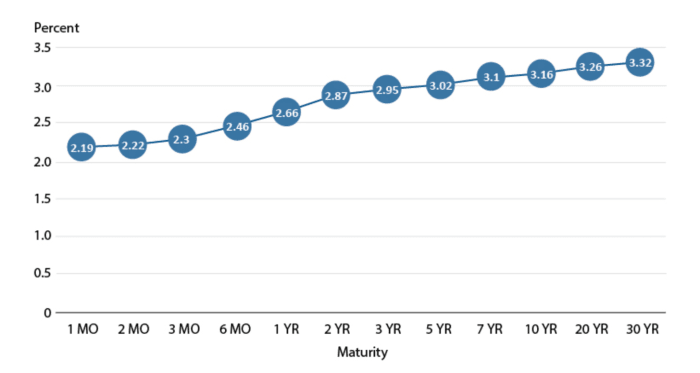

The yield curve is essentially a chart outlining all the existing nominal (not consisting of inflation) rates of each government-issued bond. Maturity is the term for a bond, and yield is the yearly rates of interest that a bond will pay the purchaser.

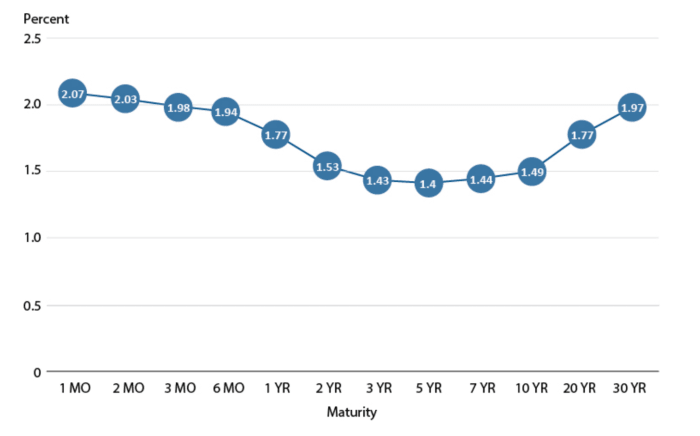

A typical yield curve (this one from 2018) chart will normally appear like this:

SOURCE: FRED ®, Federal Reserve Bank of St. Louis

The Fed sets what is called the federal funds rate, and this is the quickest rate of interest you can get a quote on, as it is the rate (annualized) that the Fed recommends industrial banks obtain and provide their excess reserves to each other over night. This rate is the criteria that all other rates are priced from (approximately, in theory).

As you can see, in a regular financial environment, the much shorter the maturity of the bond, the lower the yield. This makes best sense because, the much shorter the time dedicated to providing cash to somebody, the less interest you would charge them for that concurred lockup duration (term). How does this inform us anything about future financial declines or possible economic downturns?

That's where yield curve inversion enters play and what we will take on next.

What Does It Mean When It's Inverted?

When shorter-term bonds, like the 3-month or the 2-year, begin to show a greater yield than longer-term bonds, 10- year or perhaps 30- year, then we understand there is anticipated difficulty on the horizon. Essentially, the marketplace is informing you that financiers are anticipating rates to be lower in the future since of a financial downturn or economic crisis.

So, when we see something like this (e.g., August 2019):

SOURCE: FRED ®, Federal Reserve Bank of St. Louis

... where the 3-month and 2-year bonds are yielding more than the 10- year bonds are, financiers begin to get worried.

You will likewise often see it revealed like below, revealing the real spread in between the 2-year and the 10- year rates of interest. Notification the short-lived inversion back in August 2019 here:

SOURCE: FRED ®, Federal Reserve Bank of St. Louis

Why does it matter so much, if it is simply an sign and not a truth?

Because inversion not just reveals an anticipated decline, however can really create chaos in the financing markets themselves and trigger issues for business along with customers.

When short-term rates are greater than long-lasting, customers who have variable-rate mortgages, house equity credit lines, individual loans and charge card financial obligation will see payments increase due to the fact that of the increase in short-term rates.

Also, revenue margins succumb to business that obtain at short-term rates and provide at long-lasting rates, like lots of banks. This spread collapsing triggers a sharp decline in revenues for them. They are less prepared to provide at a lowered spread, and this just perpetuates loaning issues for lots of customers.

It's an agonizing feedback loop for all.

What Is Yield Curve Control?

No surprise, the Fed has a response to all this-- do not they constantly? In the type of what we call yield curve control ( YCC). This is essentially the Fed setting a target level for rates, then getting in the free market and purchasing short-term paper (1-month to 2-year bonds, generally) and/or selling long-lasting paper (10- year to 30- year bonds).

The purchasing drives the short-term bond rate of interest lower and the selling drives the long-lasting bond rate of interest greater, thus stabilizing the curve to a "much healthier" state.

Of course, there's an expense to all this with the most likely growth of the Fed's balance sheet and additional growth of the cash supply, particularly when the free market does not take part at the level essential for the Fed to accomplish its targeted rates.

Result? Possible exacerbated inflation, even in the face of a contracting economy. Which is what we call stagflation Unless the control of the curve assists avoid a pending economic crisis and financial growth resumes: a huge "if."

What Is The Eurodollar And How Does It Fit Into All This?

A eurodollar bond is a U.S. dollar-denominated bond released by a foreign business and kept in a foreign bank exterior both the U.S. and the provider's house nation. A bit complicated, as the prefix " euro" is a blanket recommendation to all foreign, not simply European business and banks.

More significantly, and in our context here, eurodollar futures are interest-rate-based futures agreements on the eurodollar, with a three-month maturity.

To put it just, these futures will trade at what the marketplace anticipates U.S. 3-month rates of interest levels will remain in the future. They are an extra information point and sign of when the marketplace anticipates rate of interest to peak. (This is likewise referred to as the terminal rate of the Fed cycle.)

For circumstances, if the December 2023 eurodollar agreement reveals an implied rate of 2.3% and the rates decreasing to 2.1% in the March 2024 agreement, then the anticipated peak for the fed funds rate would be at completion of 2023 or early 2024.

Simple as that, and simply another location to search for hints of what financiers are believing and anticipating.

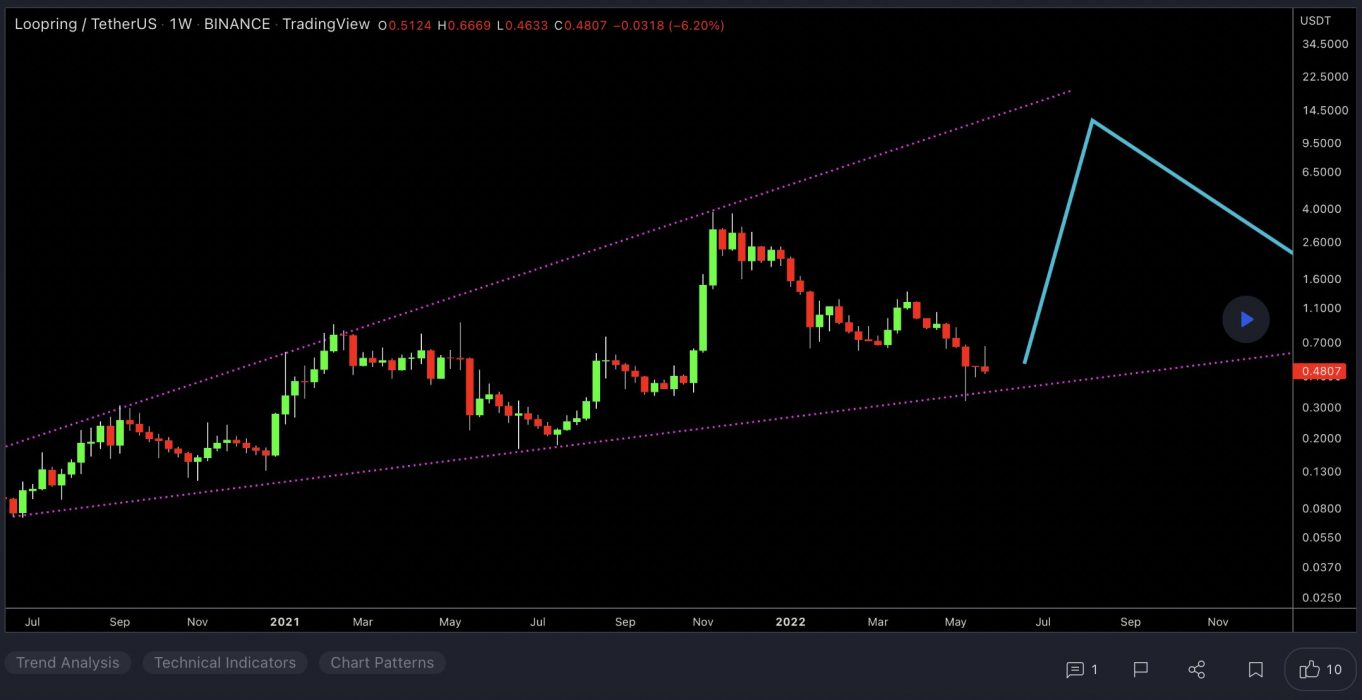

What You Can Do About It ... (Yep-- Bitcoin)

Let's state you're seeing rates carefully and hearing that the Fed is going to begin utilizing YCC to handle the rate curve, therefore printing more cash and, in turn, most likely triggering more long-lasting inflation. And what if inflation in some way leaves control? How can you secure yourself?

It does not matter when you read this, as long as the world is still running mostly with fiat (government-issued and "backed") cash, bitcoin stays a hedge versus inflation and insurance coverage versus run-away inflation. I composed an easy however comprehensive thread about that here:

To determine the inflation hedge qualities of Bitcoin, it's easy actually. Since Bitcoin is governed by a mathematical formula (not a board of directors, CEO, or creator), the supply of bitcoin is definitely restricted to 21 million overall.

Furthermore, with a really decentralized network (the computer systems that jointly govern the Bitcoin algorithm, mining, and deal settlements), settled deals and overall variety of bitcoin to be minted will never ever alter. Bitcoin is for that reason immutable.

In other words, Bitcoin is safe.

Whether or not the rate of bitcoin (BTC) is unpredictable in the short-term does not matter as much as the truth that we understand the worth of the U.S. dollar continues to decrease. And in the long term and in overall, as the dollar decreases, BTC values. It is for that reason a hedge versus long-lasting inflation of not simply the U.S. dollar, however any government-issued fiat currency.

The finest part? Each single bitcoin is comprised of 100 million "cents" (really the tiniest system of bitcoin - 0.00000001 btc - is called satoshis, or sats), and one can for that reason purchase as much or as little they can or wish to in a single deal.

$ 5 or $500 million: You call it, Bitcoin can manage it.

This is a visitor post by James Lavish. Viewpoints revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine

Read More https://bitcofun.com/yield-curves-inversion-the-eurodollar-and-bitcoin/?feed_id=22139&_unique_id=6297057f3b95f