Exchange-traded funds (ETFs) backed by bitcoin (BTC) futures agreements traded in the UnitedStates mostly maintained their trading volumes last week, inspiteof a depression in the bitcoin rate over the course of January.

According to exchange information, the ProShares Bitcoin Strategy ETF (BITO) – the veryfirst bitcoin ETF to go live in the UnitedStates in October last year – saw trading volumes of 40.83m shares throughout the week from February 7 to 11.

The trading volume marks an boost from the week priorto when 31.53m shares were traded, and it's approximately in line with the typical weekly trading volume of 38.98m shares because the ETF released.

BITO cost and trading volume (bottom) giventhat launch:

Even more unexpected, possibly, is that trading volumes in the second bitcoin ETF to launch, the Valkyrie Bitcoin Strategy ETF (BTF), haveactually increased substantially because last year, regardlessof bitcoin’s rate depression.

During the week from February 7 to 11, 7.54m shares of BTF were traded, its greatest level ever, exchange information programs. Notably, the ETF saw a significant uptick in trading volume around the end of last year, with the greater average volume still staying to this date.

Compared with last year’s average weekly trading volume of 2.52m shares, the volume in BTF has more than doubled this year to an typical weekly volume of 5.3m shares.

The launch of BTF was mainly eclipsed by the effective veryfirst launch of BITO, with the 2nd bitcoin ETF to this day staying a far cry behind BITO in terms of volume.

BTF cost and trading volume (bottom) because launch:

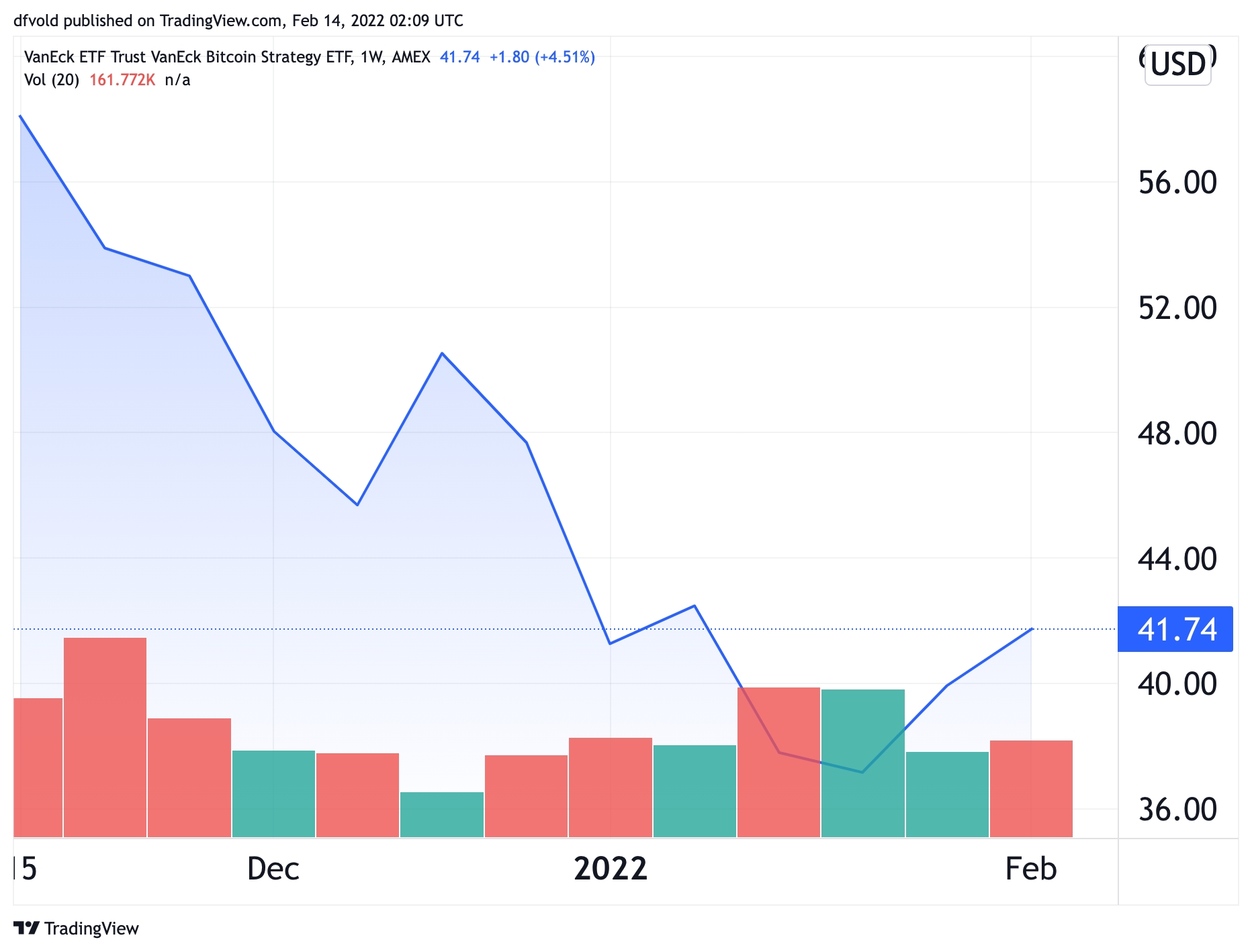

Lastly, the third US-listed bitcoin ETF, the VanEck Bitcoin Strategy ETF (XBTF), has likewise seen a amazing strength in terms of volume because the bitcoin cost peaked in November last year.

Although the all-time high in the weekly volume of 0.34m shares for this ETF followed soon after the cost peaked, trading volume was back at close to the exactsame level as justrecently as in January, with 0.25m shares traded in the week from January 17 to 31, exchange information programs.

XBTF cost and trading volume (bottom) consideringthat launch:

Between January 1st and 31st, bitcoin’s cost dropped by about 17% from around USD 46,200 at the start of the month to 38,400 at the end of the month.

BTC cost giventhat January 1:

The significant strength in the trading volumes of ETFs backed by bitcoin was highlighted on Twitter last week by Bloomberg’s senior ETF expert, Eric Balchunas, who stated that the ETFs “have kept their trading volume and much of their financier base.”

This has tookplace regardlessof “a harsh 50% drawdown” in the area market, Balchunas stated, calling it “a excellent indication for [the ETFs] remaining power and development capacity.”

Balchunas’ tweet came as a Bloomberg Intelligence report by experts Rebecca Sin and James Seyffart said that trading volume in “crypto ETFs” stayed steady in January, with fairly little circulation decreases.

Spot-based bitcoin ETFs in the UnitedStates stay a 'maybe'

Bitcoin stays the just cryptoasset in which financiers can invest bymeansof ETFs on the controlled UnitedStates stock exchanges. However, some experts have hypothesized that an ethereum (ETH) ETF might be coming next.

Also worth keepinginmind is that the bitcoin ETFs that are presently offered have handled to preserve high trading volumes regardlessof insomecases being pestered by tracking mistakes relative to the area cost of bitcoin. These tracking mistakes happen duetothefactthat agreements outdated into the future typically trade at either a premium or a discountrate to the area rate of bitcoin.

In addition, the futures agreements support the ETFs needto be rolled over each month as they end, including intricacy and expenses to the management of the funds.

To prevent this issue, a number of business haveactually used to list spot-based bitcoin ETFs that would track the underlying cost straight.

So far, the US Securities and Exchange Commission (SEC) has rejected all such applications. However, one indication that it might be about to reconsider its position emerged this week when the regulator lookedfor public recommendations about whether area bitcoin ETFs might be utilized for scams or market control, per a Bloomberg report.

For now, nevertheless, futures-based bitcoin ETFs stay the just videogame in town and have endupbeing the chosen option for the traditionally-minded financiers who are lookingfor directexposure to the property.

And with high trading volumes continuing through the past coupleof months’ cost downturn, it appears that strong need for bitcoin exists even amongst standard stock financiers.

____

Read More. https://bitcofun.com/bitcoin-etfs-remain-popular-among-investors-despite-price-slump/?feed_id=8690&_unique_id=621d45133b920

No comments:

Post a Comment