The US Federal Reserve (Fed) raised interest rates by 25 basis points today, marking the veryfirst rate walking in the UnitedStates because priorto the COVID-19 pandemic. The boost was in line with what the main bank has long interacted to the market that it would do.

“[…] the Committee chose to raise the target variety for the federal funds rate to 1/4 to 1/2 percent and expects that continuous increases in the target variety will be suitable. In addition, the Committee anticipates to start minimizing its holdings of Treasury securities and company financialobligation and company mortgage-backed securities at a coming satisfying,” the Fed’s statement said.

The cost of bitcoin (BTC) dropped rightaway following the statement, trading down by 1.3% to USD 39,900 in the veryfirst 5 minutes after the release of the Fed’s declaration. At the exactsame time, the US S&P 500 stock index dropped 0.5%.

The Fed’s statement likewise stated that the ramifications of Russia’s intrusion of Ukraine are “highly unsure” for the UnitedStates economy, however keptinmind that it is “likely to develop extra upward pressure on inflation.”

The Fed more signified that it anticipates to raise rates 6 more times this year, and 3 more rate increases in 2023.

The boost in the interest rate was likewise extensively anticipated by experts, who have long argued that the Fed needsto raise rates in order to get the justrecently high inflation in the UnitedStates under control.

Last month, inflation in the UnitedStates reached 7.9%, its greatest level because January1982 The level is well above the Fed’s specified objective of keeping inflation at 2% per year “over the longer run.”

The choice today comes after Fed Chairman Jerome Powell informed Congress earlier in March that the main bank would “proceed thoroughly” with its strategy to walking interest rates this year inspiteof the war in Ukraine.

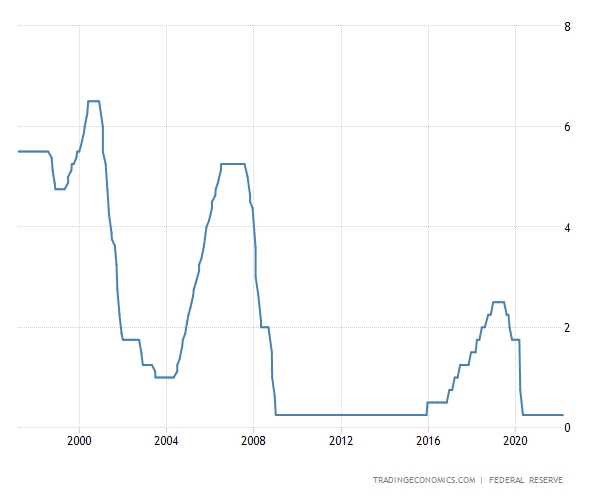

US Federal Fund Rate 25-year chart:

Before the war broke out, some economicexperts revealed unpredictability as to whether the Fed would raise rates by 50 basis points at today’s conference rather of 25, provided the high level of inflation. With the war occurring, nevertheless, a 50 basis point walking now appears notlikely, experts state.

“If not for the geopolitical occasions, 50 basis points would definitely be on the table at this conference,” Nathan Sheets, chief worldwide economicexpert at Citi, told the Wall Street Journal. “The one thing Powell can do is to hold out the possibility of 50 down the roadway,” he included.

Meanwhile, inspiteof the Fed’s choice being extensively anticipated by the market, Marcus Sotiriou, an expert at digital possession broker GlobalBlock, stated that volatility oughtto still be anticipated.

He included that the statement will offer more clearness as to whether the Fed “still strategies on bring out a sluggish and constant rate walking,” which he stated, “will not shock the market.”

Similarly, Pankaj Balani, CEO of the crypto derivatives exchange Delta Exchange, likewise alerted of increased volatility.

“We haveactually seen interest to own the brief term and medium-term volatility on BTC at the existing levels and anticipate it to trade strongly around the Fed conference lateron today,” Balani stated in an emailed remark.

Also, CEO of crypto consultancy Eight and popular trader Michaël van de Poppe said on Twitter that the veryfirst relocation will mostlikely be “a fake-out relocation.”

The fake-out will be followed by “the genuine relocation, and then really end up in a panic relocation general,” van de Poppe anticipated.

Commenting on bitcoin’s potentialcustomers as the Fed begins its tighteningup cycle, the crypto financier Mike Novogratz, who is the creator & CEO of Galaxy Digital, told Bloomberg TELEVISION that last year’s bitcoin rally ended mainly because the Fed endedupbeing more “hawkish.”

“I puton’t think Bitcoin can rally strongly till we get a stopbriefly,” Novogratz stated, referring to the Fed’s rate walkings and highlighting that “bitcoin is a narrative story.”

However, he likewise worried that he is still a long-lasting bitcoin bull.

“Five years out, if bitcoin’s not at [USD] 500,000, I’m incorrect on the adoption cycle,” Novogratz stated.

Read More. https://bitcofun.com/fed-raises-interest-rate-by-25-basis-points-in-first-rate-hike-since-2018/?feed_id=13835&_unique_id=624a289f08523

No comments:

Post a Comment