This is a viewpoint editorial by Tom Luongo, a previous research study chemist and financial/political analyst concentrating on the crossway of geopolitics, monetary markets, gold and cryptocurrencies.

This is a viewpoint editorial by Tom Luongo, a previous research study chemist and financial/political analyst concentrating on the crossway of geopolitics, monetary markets, gold and cryptocurrencies. The Federal Reserve is on the attack, however not versus inflation. Oh, they state their shift in financial policy has to do with inflation, however that's a cover story for what's actually going on. There is a titanic defend the future of not simply cash, however for humankind itself, and the Fed remains in one corner of the ring.

Newly reconfirmed Federal Open Market Committee (FOMC) chair Jerome Powell and the Fed have a much larger target in mind than any of its "normal suspects," i.e., the " outdoors cash" group of safe-haven possessions: gold, silver, bitcoin.

If you recognize with my work, you'll understand the response to who that target is. If you aren't, keep reading, and keep an open mind.

For now, bitcoin is captured in the middle.

The world is all a-Twitter (actually) over the Fed's current transfer to raise rates by 75 basis points (or 0.75%) throughout the board. I wasn't. I 'd presumed for a while that Powell desired to go "75" however could not politically.

Then he was "summoned" by President Joe Biden to go over financial policy. Now, all of us understand what this conference had to do with. It was Biden, believing he was still the Godfather, informing the Fed to withdraw prior to the midterm elections.

Going into that conference I put a 25% possibility of 75 bps. Did the rest of the market.

Biden's remarks later on about appreciating the Fed's self-reliance while looking beaten raised that likelihood to 75%. The May customer cost index being available in hotter than expectations at 8.6% raised that to near certainty.

Not just did the Fed go through with the 75- basis point raise, it is discussing doing it once again at the next conference in late July. Sorry Biden, the genuine Godfather lives at the Marriner S. Eccles structure, not the White House.

Powell has not just resumed his pre-COVID-19 hawkishness, however he's taken it up a notch.

The stated factor was speeding up inflation. The May U.S. CPI number offered everybody rather a shock. Nobody was most likely better with that number, nevertheless, than Powell. It offered him all the cover he required to do what he wished to do anyhow.

The markets right away responded severely to the report: It was a "offer whatever Friday." Blue-light specials in capital markets that day were as typical as bots lamely safeguarding Biden on Twitter.

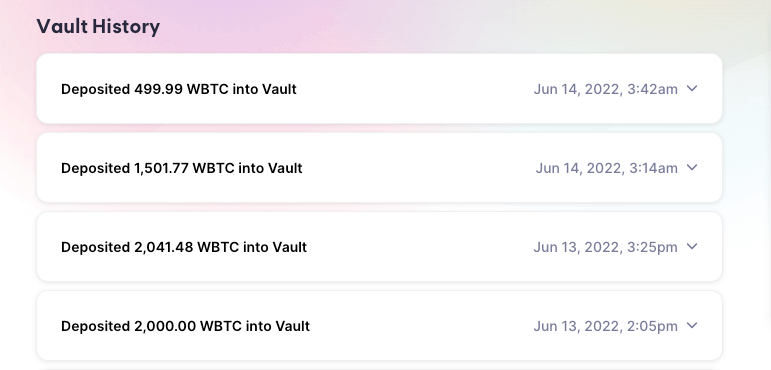

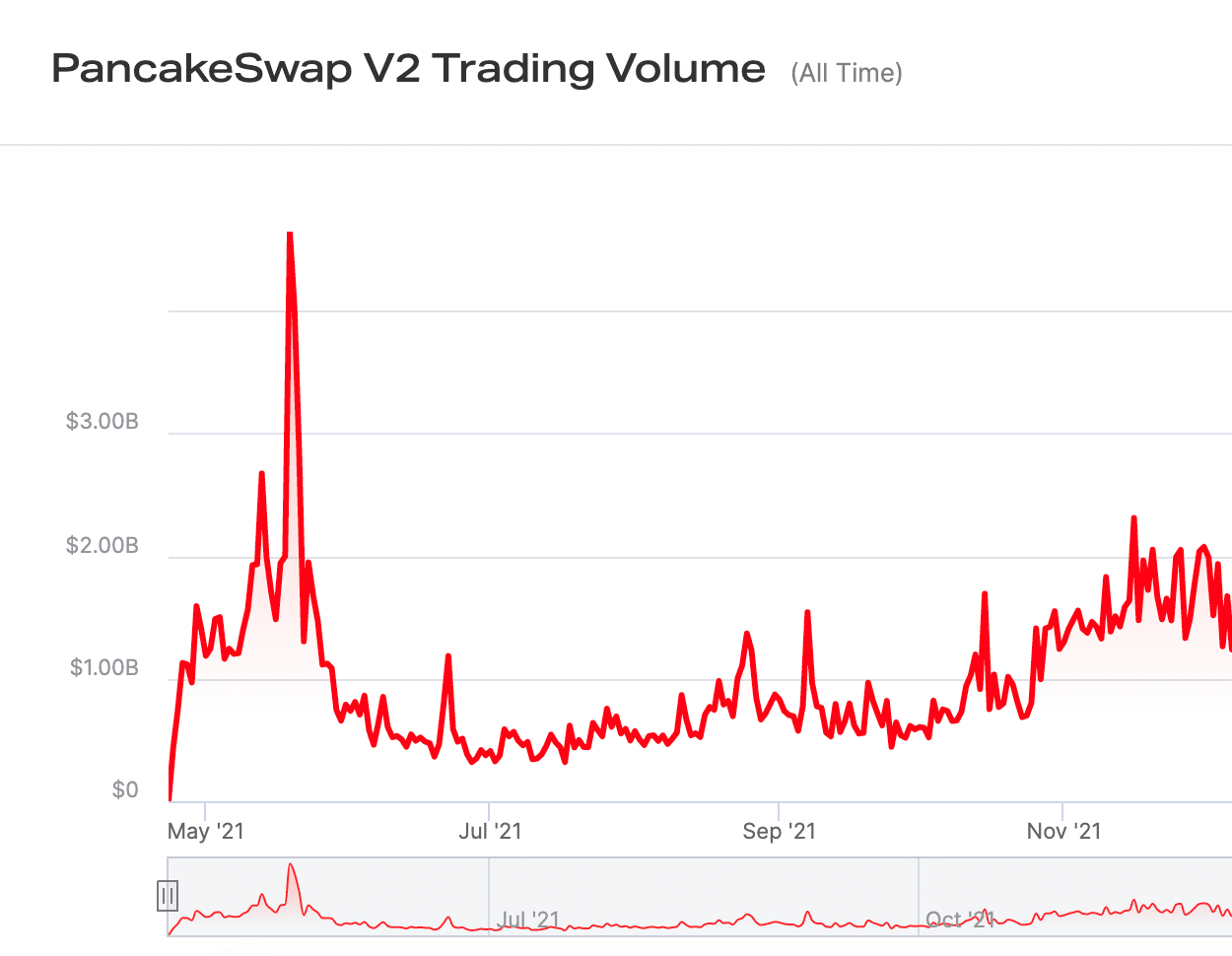

This selling consisted of, naturally, bitcoin. Basically, falling U.S. dollar liquidity around the world ways falling bitcoin liquidity and after that, by extension, seizure of one cryptocurrency market after another. With the crazy quantity of take advantage of current within the DeFi area, it's not difficult to see what occurred here and what's simply over the horizon.

If you still do not comprehend the inverted relationship in between HODLing and bitcoin volatility, then I recommend you evaluate a fundamental course in supply and need.

A great deal of individuals lastly awakened from their rest and recognized that for the very first time because Alan Greenspan supervised, the Fed might not exist to bail everybody out this time. Possibly, simply possibly, Powell is severe about stabilizing rates and letting the chips fall where they might.

This procedure is sluggish. There are a great deal of mental barriers to conquer to alter individuals's thinking. A lot of individuals adhere to their financial investment thesis well past its use-by date. This leaves them and markets really susceptible to the sort of shocks we've seen in current months as the Fed has actually now raised rates of interest by 50 basis points more than many contrarian experts believed was practical.

Go check out the ideas of the typical goldbug and you'll see what I'm discussing.

Powell had a great deal of inertia to conquer, which inertia was well established in the minds of financiers and market experts.

Inflation Coordination

For 13 years given that the fall of Lehman Brothers, the marketplaces got utilized to the collaborated financial policy in between the world's significant reserve banks. The Gang of Five: The Fed, The Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, took part in what I've called "round robin quantitative easing (QE)." In impact, these 5 reserve banks took turns inflating their cash materials while swap lines, bring trades and broadening international trade kept the system fairly liquid.

The Bank of Japan is presently trashing the yen to play wingman to Powell's Maverick, if I might purchase a tacky "Top Gun" recommendation here, putting severe pressure on the Hong Kong dollar's peg to the U.S. dollar. Long story short, Powell's aggressiveness has aftershocks and ripple effects far larger than what's taking place in the cryptocurrency corner of the world.

The Chinese played in addition to this charade to their advantage anytime the system started to teeter off-center, utilizing countercyclical financial policy to keep the U.S. economy from collapsing. They gladly transformed their U.S. dollar trade surplus into facilities tasks all over Asia and Africa. This is called China's Belt and Road Initiative.

Exchange rates were basically pegged and there was high self-confidence that the reserve banks had actually conserved the world. This is why gold suffered through a harsh bearishness through completion of 2015 and is still suffering listed below even the 2011 high 11 years later on.

Bitcoin was born since of this mess and merely drew in sufficient capital getting away the madness to develop itself as a genuine alternative possession class for individuals trying to find optionality.

It's got a long method to go to get rid of the current inertia of the present system. Due to the fact that of this, its dollar rate will be the toy of these very same main lenders, prop desk traders and power brokers attempting to protect their location in the financial supremacy hierarchy.

The petrodollar requirement as the worldwide reserve currency which was developed by Richard Nixon in 1971 and provided its sea legs by Paul Volcker, ended in2008 In 2011, the "collaborated reserve bank" requirement with the U.S. dollar at the center was developed by revealing reserve bank swap lines and a $500 billion slush fund, which was what lastly broke gold's booming market in September of that year.

Powell, in my read of him and history, has actually been attempting to liberate the Fed from this circumstance considering that he took control of as FOMC chair. They raised rates strongly in 2018 just to be required back down a bit in2019 He and John Williams at the Atlanta Fed pressed through the development and application of SOFR (the Secured Overnight Funding Rate), which was a replacement for LIBOR (the London Interbank Overnight Rate). SOFR is the secret, I think, to the Fed's endgame, which I've blogged about formerly

The reverse repo crisis of September 2019 was a direct outcome of U.S. banks, especially JP Morgan Chase, contradicting European financial obligation as security, producing a dollar liquidity occasion which saw SOFR burn out to over 10% as banks rushed for limited dollars, which the Fed needed to supply by opening its repo center back up.

I'm uncertain if this was completion of the "collaborated reserve bank" requirement, however September 2019 is absolutely a prospect for financial historians to go over. Powell was required-- through our very first flirtation with Modern Monetary Theory (MMT) with the CARES Act-- to desert his hawkishness throughout COVID in 2020.

Once COVID was basically over, Powell was complimentary to start getting rid of the Fed from the Davos-inspired orthodoxy as revealed by the European Central Bank's Christine Lagarde's remarks that the reserve banks would all now need to collaborate policy to fight environment modification.

Powell openly dissented in June of 2021, simply 2 weeks prior to he would start stealthily tightening up by raising the payment rate on reverse repo (RRP) agreements by 0.05% or 5 bps.

Powell firmly insisted "we are not, and we do not look for to be, environment policy makers. We have an extremely particular required, and valuable self-reliance ... which has actually served the general public well ... that's not up to us ... however I do believe our work can indirectly inform the general public and likewise I would believe notify other parts of the federal government in the actions they are designated to examine."

A current interview with previous Fed expert Danielle Dimartino Booth deserves your 20 minutes to get a sense of what's actually going on. She intimated (since she can't state the peaceful parts out loud) that the Fed is raising rates for factors besides "combating inflation."

I determined Powell's usage of the RRP center to drain pipes abroad markets almost right away and started forming the core thesis around which this short article and a great deal of my other commentary is based:

- The Fed isn't raising rates to eliminate inflation.

- The Fed is raising rates to break the European Central Bank and the overseas or eurodollar markets.

At the next FOMC conference in July 2021, Powell revealed a brand-new foreign repo center, to provide overseas banks access to dollars which were rejected them by the U.S. business banks.

By doing this, the Fed now had even more control over U.S. dollar inflow and outflow through the so-called shadow banking system than it had formerly. It had actually taken an enormous quantity of cash out of the system through reverse repos and might utilize its enormous stock of U.S. Treasurys to set the rate of security for overseas markets once it started raising rates.

And that's where we are today.

Powell Versus Bitcoin

With this architecture in location, the argument versus temporal inflation in the rearview of the overton window and an energy-based war raving in Eastern Europe, the Fed is now distinctively placed to put an end to the crippling financial and financial policy of globalist organizations which are the bane of the majority of our presences.

Make no error, nevertheless, I do not believe the Fed is doing any of this for our advantage. They are acting in this manner on behalf of their benefactors, the U.S. industrial banking interests. Davos is the sworn opponent of the last vestiges of commercialism left in Western markets. That starts and ends with fundamental industrial banking.

Our concerns over reserve bank digital currencies (CBDCs) and the social credit system they suggest are genuine, however they are more than genuine to the banking sector.

And while I comprehend this is a short article for a Bitcoiner audience, it's crucial for you to comprehend the characteristics at play in the conventional financing world. They are still really effective and their defend supremacy might be useless in the face of bitcoin in your viewpoint, reasonable police. I have adequate experience as a gold man to understand that conventional financing world can hang on for a lot longer than anybody ever anticipated.

So forewarned is forearmed, as it were.

We're here today at the inflection point in financial history comparable to September 2008 when Lehman Brothers imploded over night. At that time, I was persuaded the system had, at a lot of, 5 years left. I was incorrect.

This time, it will remove a continent's worth of banks and possibly a significant reserve bank. The ECB's emergency situation conference the day of the Fed's rate statement left the marketplaces seriously underwhelmed.

We have no concept the length of time it will consider this duration of financial history to work itself out, however the speed of occasions is speeding up.

Today, the Fed is on the attack to conserve itself from its opponents. It has actually fortified its defenses, constructed a war chest of possessions and is now releasing monetary weapons of mass damage.

The very first stage of this battle is a mass flight into the U.S. dollar. Overleveraged cryptocurrency markets have actually been beaten down. Bitcoin dropped listed below $20,000 from highs of $68,000 per coin a couple of months earlier.

Gold is incapable of rallying at this moment in time as access to dollars controls everybody's thinking due to the fact that inflation genuine items-- food, energy, healthcare, lease-- raves. This does not lessen the long-lasting thesis for bitcoin and/or other safe-haven properties, however it does suggest that the short-term will be extremely rocky, like it has actually been for the previous 3 months,. Really frightening.

The Fed might be the greatest Ponzi plan worldwide, however everybody else's evaluations are based upon it, consisting of bitcoin's. If the Fed chooses to diminish its balance sheet, it can and will collapse all the others. Powell is wagering the farm on this, while concurrently comprehending that to eliminate inflation and bring back sustainable financial development, it initially indicates liquidating all the uneconomic jobs and expensive properties.

It suggests relinking worldwide liquidity and the worth of cash with the genuine expenses related to developing genuine wealth. I do not believe Bitcoin fears the Fed since Bitcoin is simply code. Bitcoiners, on the other hand, who are connected to the rate and not simply stacking sats, require to recognize the tremendous power that the Fed still has, and when confronted with an existential hazard to its future, the lengths it will go to protect itself and those banks whose interests it represents.

Once you accept this, just then can you see the enormous chance in front of you to make the right choices at the correct times and browse your method through this critical duration of history.

This is a visitor post by Tom Luongo. Viewpoints revealed are totally their own and do not always show those of BTC Inc. or Bitcoin Magazine.

Read More

https://bitcofun.com/is-bitcoin-afraid-of-big-bad-jerome-powell/?feed_id=26387&_unique_id=62be37d315738

This is a viewpoint editorial by Tom Luongo, a previous research study chemist and financial/political analyst concentrating on the crossway of geopolitics, monetary markets, gold and cryptocurrencies.

This is a viewpoint editorial by Tom Luongo, a previous research study chemist and financial/political analyst concentrating on the crossway of geopolitics, monetary markets, gold and cryptocurrencies.

Cryptocurrencies

Cryptocurrencies

Cryptocurrencies

Cryptocurrencies