Cryptocurrencies

Cryptocurrencies  Celsius races to include more security to Maker as risk of liquidation looms Andjela Radmilac ·15 hours earlier · 2 minutes read

Celsius races to include more security to Maker as risk of liquidation looms Andjela Radmilac ·15 hours earlier · 2 minutes read

Celsius transferred 2,000 WBTC to their security throughout the night in an effort to get more breathing space prior to their $534 million Maker vault ends up being susceptible to liquidation.

Cover art/illustration through CryptoSlate

Crypto loaning company Celsius has actually been racing to top up its security on Maker to raise its properties' liquidation rate.

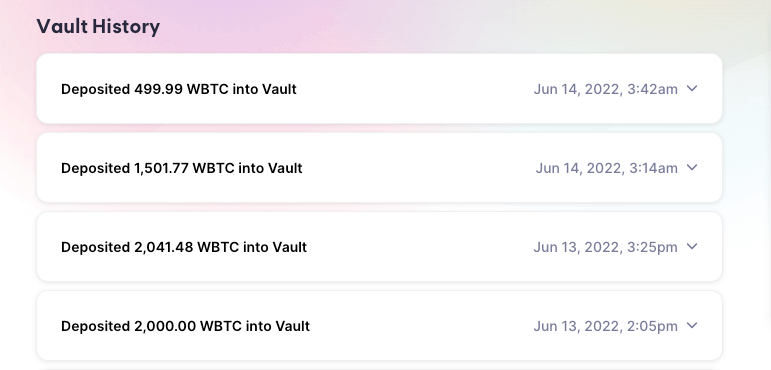

The business included simply over 2,000 Wrapped Bitcoin (WBTC) to its security on June 14, transferring 1,50177 WBTC and 499.99 WBTC to its vault.

Cryptocurrencies Celsius directly prevents WBTC liquidation

A fast security top-up has actually conserved Celsius from a mass liquidation that might have had terrible impacts on the business and the whole market.

Struggling with a liquidity crisis caused by the depegging of stETH and ETH, Celsius ended up being susceptible to another liquidation-- this time of its enormous take advantage of on Maker procedure. Celsius has actually opened a loan on Maker to supply low-rate loaning for its users by putting in around 20,000 Wrapped Bitcoin (WBTC) as security.

On June 13, the platform had simply under $479 million in security locked on Maker. The position would start to liquidate as soon as Bitcoin reached $20,272 as it put Celsius in threat of stopping working to repay its financial obligation. The very same day, Celsius transferred 4,04148 WBTC to its vault, decreasing its liquidation rate to under $20,300

However, quickly dropping costs have actually pressed BTC to crucial levels, falling listed below the $21,000 resistance level. At several points throughout the day, Bitcoin's cost was simply numerous percent far from setting off liquidations on Celsius' position.

Celsius has actually topped up its security once again to purchase more time and fend off liquidations as much as possible, including 1,50177 WBTC and 499.99 WBTC in 2 back-to-back deals.

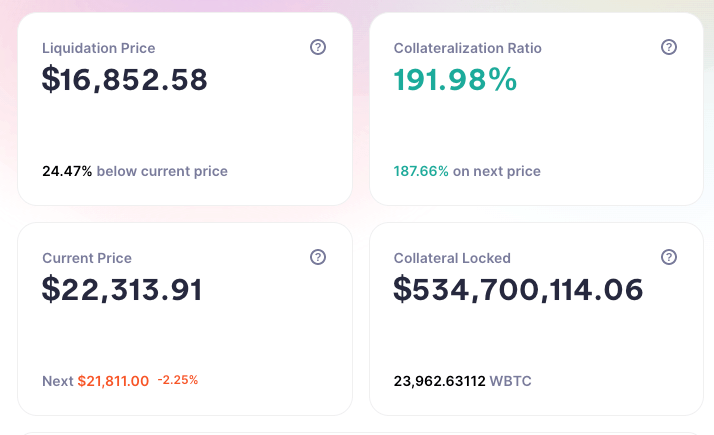

Adding 2,000 WTBC more has actually purchased Celsius a fair bit of time. The liquidation cost for its WBTC security now stands at $16,85258, simply over 24% listed below the present rate of BTC.

Celsius' newest addition brings its position to a 191.98% collateralization ratio, with the platform now having more than 23,962 WBTC in security locked-- or $5347 million.

Cryptocurrencies Bandaids do not repair bullet holes

Despite its desperate efforts to ward off liquidations, Celsius is still in deep difficulty. Celsius has actually suspended withdrawals, swaps, and transfers amongst accounts to handle the crisis. The relocation has actually just served to trigger more worry in the neighborhood and triggered a huge dip in the worth of its native token, CEL.

Many have actually slammed its choice to top up its security rather of repaying its loan on Maker, stating that it might have utilized the extra security to pay back any variety of its exceptional loans. Some have actually even argued that including extra security implied that the platform might not repay the loan which it took the little solvency they had actually left and bet it.

Option (b) appears 50% even worse than (a).

So why would you select it?

You 'd do it if you can't really pay back.

If you're a degenerate bettor taking the little solvency you have actually left and putting everything on black, intending to make it all back in one trade. https://t.co/IfAyoMLxyG

-- jonwu.aztec (@jonwu_) June 13, 2022

All of the unpredictability concerning Celsius' capability to repay its clients' loans and its leveraged positions has actually made the cost of BTC and ETH tumble. In turn, these falling rates have actually reduced the worth of its security much more.

According to DeFi Explore, Celsius has an arrearage of 278.5 million DAI.

Read More https://bitcofun.com/celsius-races-to-include-more-security-to-maker-as-hazard-of-liquidation-looms/?feed_id=26363&_unique_id=62bdff1d75ae1

No comments:

Post a Comment