As Bitcoin (BTC) and the more comprehensive crypto market are attempting to recuperate after diving listed below vital levels this previous weekend, experts are digging into information, attempting to recognize the next actions in the marketplace.

" The selloff over the weekend can be thought about to have actually plunged success and financiers into a traditionally significant degree of monetary discomfort," crypto analytics company Glassnode stated in their report today.

According to them, with required sellers appearing to drive much of the current sell-side, the marketplace may start to eye whether signals of seller fatigue are emerging over the coming weeks and months.

" Given the tighter connection in between conventional markets like the NYSE, the Nasdaq, and the crypto markets, I do not believe the [BTC] bottom remains in. I believe a couple of things require to take place for the bottom to strike: 1. Inflation requires to relieve, 2. Joblessness requires to support and 3. Weaker United States dollar," Shayne Higdon, Co-Founder and CEO of the HBAR Foundation, stated in an emailed remark.

On Monday at 16: 01 UTC, bitcoin traded at USD 20,786, up 4% for the past 24 hours and down 22% for the previous 7 days. At the exact same time, ethereum (ETH) stood at USD 1,132, up 6% for the day and down nearly 22% for the week.

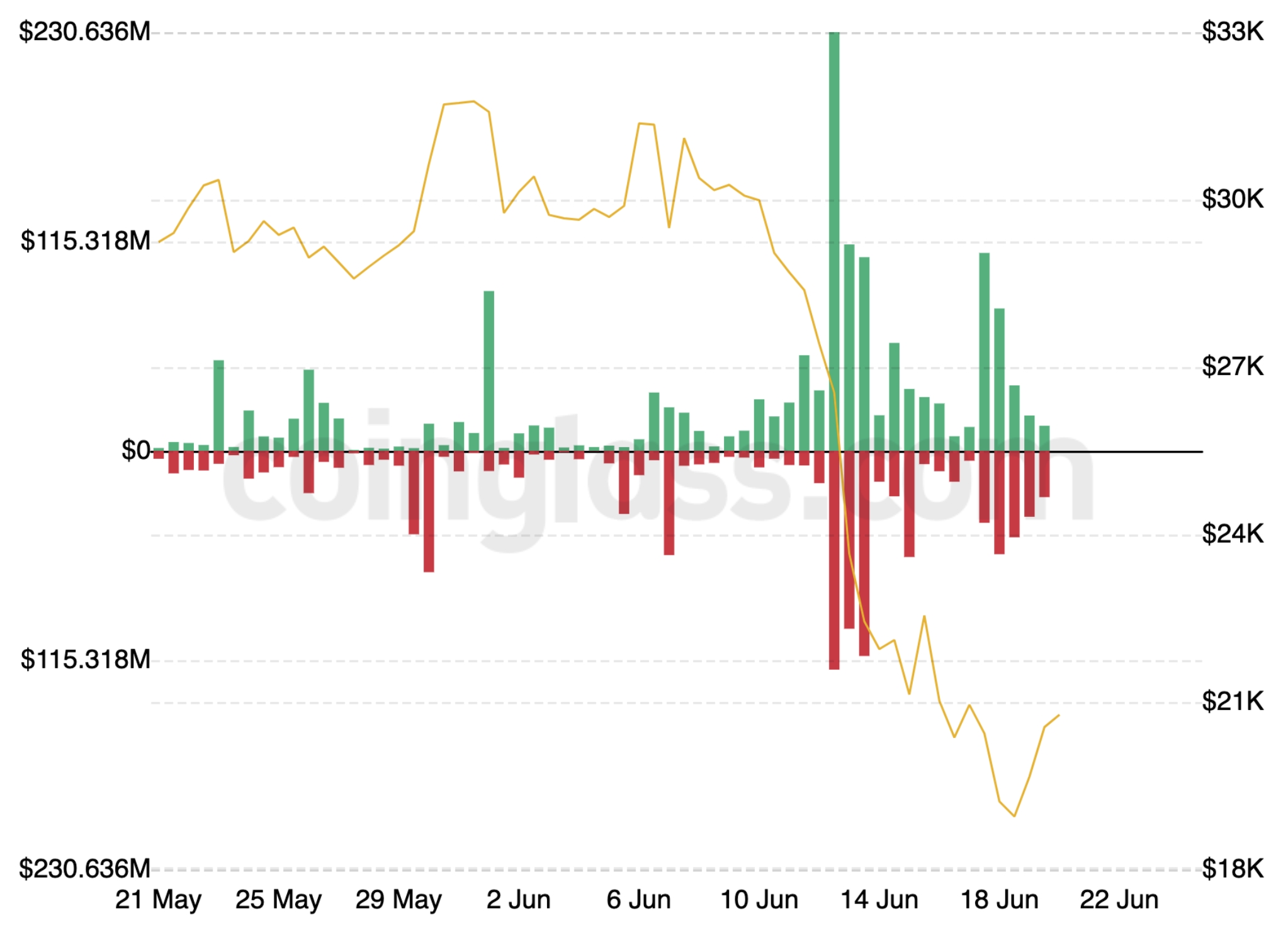

Although bitcoin stayed in favorable area for the past 24 hours, the lower rates previously in the weekend triggered reasonably big liquidations of leveraged traders who were long. According to information from Coinglass, near to USD 109 m were liquidated in the 12 hours in between midnight and twelve noon on Saturday in the bitcoin market alone.

Notably, nevertheless, the liquidations were still smaller sized than the enormous long liquidations seen on June 13, when BTC fell from USD 26,000 to around the USD 22,000 level.

Marcus Sotiriou, an expert at digital possession broker GlobalBlock, mentioned that lots of altcoins have actually not seen liquidations at the very same high level as BTC and ETH, with some altcoins even revealing strength.

" This is due to the fact that bitcoin and ethereum are the main usages of security for leveraged positions, and the reality we can see on-chain the numerous liquidation rates indicates that a waterfall lower can be premeditated," Sotiriou composed in a market commentary today.

He even more included that this might be a reason that huge purchasers have not yet stepped up to make the most of the lower costs in BTC and ETH, stating "significant purchasers can see other individuals' liquidation levels."

Notably, liquidations over the weekend likewise caused a historical loss for bitcoin holders, according to Sotiriou. Pointing out on-chain information from Glassnode, the expert stated that this liquidation waterfall resulted in the biggest recognized loss in USD terms in Bitcoin's history, with over USD 7.325 bn in losses recognized by financiers.

He included that on-chain information likewise reveals that BTC holders with 1-year-old coins "capitulated" over the weekend.

Meanwhile, the long-lasting holder (LTH) supply has actually decreased by BTC 178,000 over the recently, comparable to 1.31% of their overall holdings, Glassnode stated, keeping in mind that the present costs habits by LTHs taking losses accompanies March 2020 however is not rather as serious as the 2015 or 2018 bearish market lows.

Miners under pressure

On-chain information this weekend likewise suggested that Bitcoin miners have actually come under even larger pressure which numerous have actually selected to shut off their devices.

The bitcoin on-chain expert Will Clemente of the mining and devices company Blockware Solutions discussed the information and stated that the mix of a lower BTC cost, greater trouble, and greater energy expenses "have actually put major pressure on miners' margins."

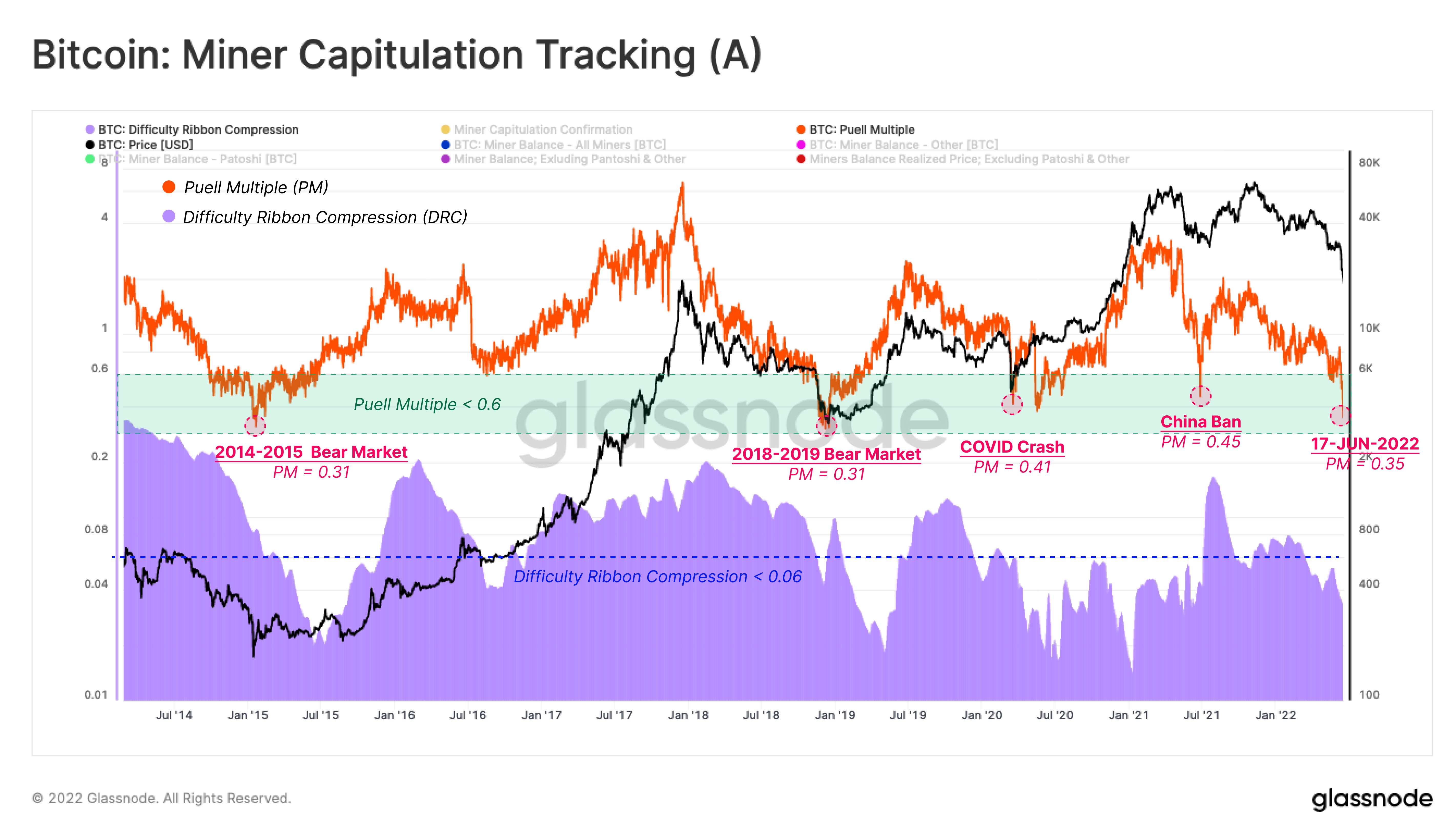

Glassnode included that miner capitulation is now "occurring in real-time":

" Miners are now under substantial monetary tension, with BTC trading near the approximated expense of production, earnings well listed below their annual average, and hash-rate significantly coming off [all-time highs]."

Using the Puell Multiple, an oscillator tracking miner USD denominated earnings, and the Difficulty Ribbon Compression design, Glassnode concluded that the contraction in miner earnings is even worse than "Great Migration in May-July 2021," when miners left China following a restriction there.

Still, "miners have actually dealt with even worse days in 2018-2019 and 2014-2015 bearish market, where the Puell Multiple reached 0.31," Glassnode stated.

BTC funds see inflows

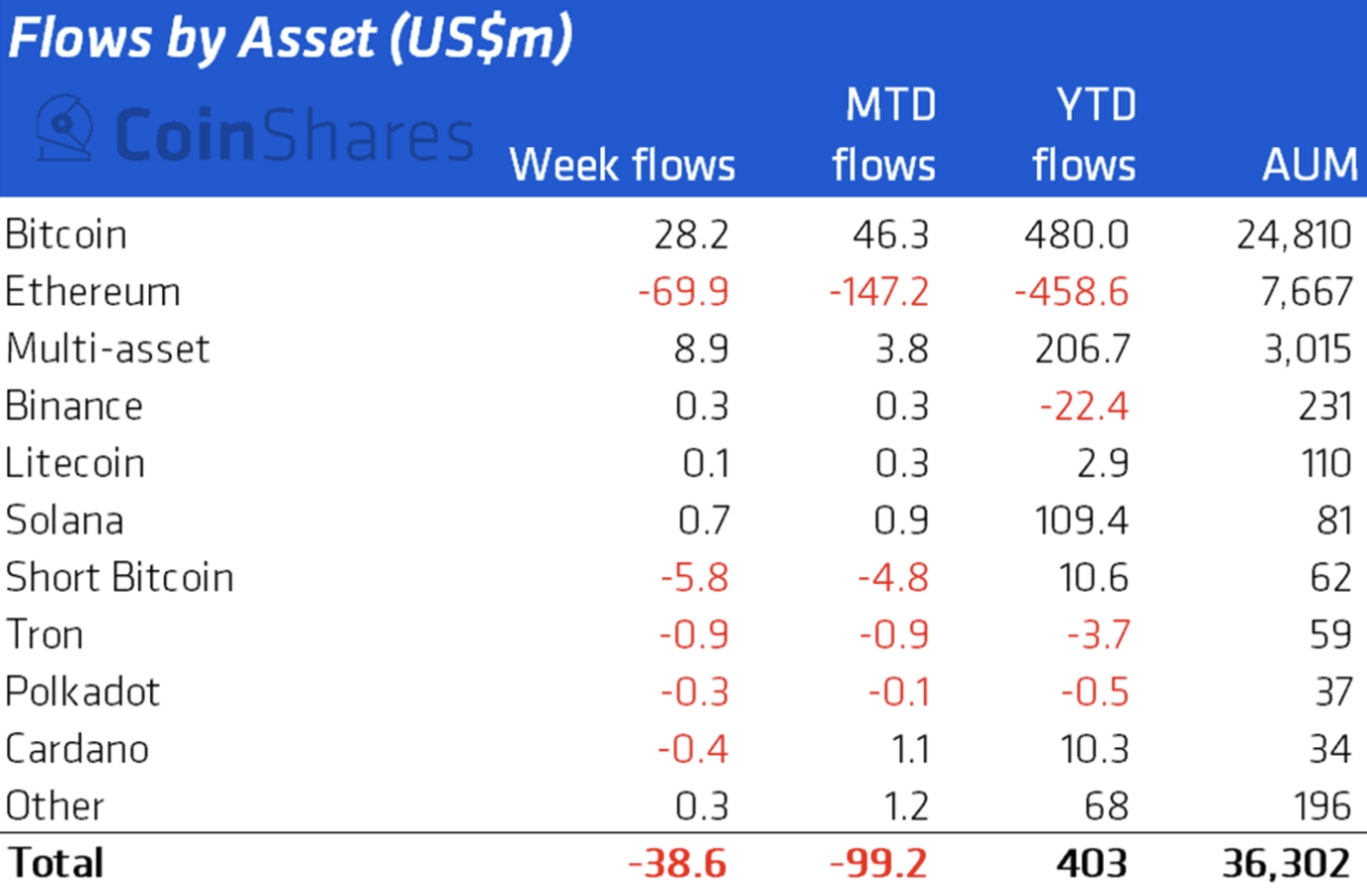

Meanwhile, the current information from CoinShares as soon as again revealed outflows from managed crypto-backed mutual fund.

Overall, USD 38.6 m left crypto mutual fund recently, with USD 69.9 m leaving ETH-backed funds alone. Still, the total figure enhanced thanks to inflows in BTC-backed funds of more than USD 28 m, in addition to smaller sized inflows into multi-asset crypto funds.

The inflows recently mark a turnaround from the week prior when USD 102 m were taken out of crypto-backed funds and USD 57 m left BTC-backed funds.

Searching for a bottom

Commenting on the wider outlook for the marketplace on Monday, Jason Choi, an angel financier and previous basic partner at crypto hedge fund Spartan Group, hinted that the crypto market might have reached peak bearishness.

" Not stating it will occur however peak belief like this typically established disliked rallies," Choi composed on Twitter, recommending that funds that are now resting on losses require to take part in prospective rallies in order to remain in organization.

A comparable belief might likewise be seen in the remarks from crypto trader Alex Krüger, who composed that a dip listed below the USD 20,000 level for BTC and USD 1,000 level for ETH would for lots of now represent purchasing chances.

This marks a shift from recently when a dip listed below the exact same levels would just trigger additional selling from "panic sellers, required sellers and breakout sellers," Krüger composed on Twitter.

He included that the variety of stop-losses under the USD 20,000 for bitcoin is "really little relative to what it was in the past."

" Many traders like me shorted 20 k and will not be shorting 20 k once again as the decreased existence of stops makes shorting much less appealing," the crypto trader composed.

Lastly, Nik Bhatia, a financing teacher at the University of Southern California and author of the bitcoin book Layered Money, advised his newsletter readers that this is far from the very first time that bitcoin experiences a selloff of this magnitude.

" Bitcoin has actually dealt with 12 drawdowns of this very same magnitude in its history, and yet it's still here," Bhatia composed in a newsletter.

He included that although bitcoin might not be acting like a safe-haven possession now, it still stays a safe house from "reserve bank cronyism, authoritarian deal controls, and currency debasement."

____

Read More https://bitcofun.com/bitcoin-ethereum-crypto-analysts-search-for-bottom-as-investors-in-historically-meaningful-degree-of-pain/?feed_id=30659&_unique_id=62e5a20bb8328

No comments:

Post a Comment