The second-largest cryptocurrency might be on the cusp of a significant rate motion.

Key Takeaways

- Ethereum has actually established a coming down triangle on its four-hour chart.

- If the $1,720 assistance level continues to hold, Ethereum might value by as much as 25%.

- Conversely, if Ethereum breaks its assistance, a downswing to $1,300 looks most likely.

Ethereum stays stagnant in a no-trade zone that is getting narrower in time. Persistence is recommended up until ETH can break out of this tight cost pocket.

Ethereum at a Crossroads

Traders seem growing restless as Ethereum continues to combine within a tight cost variety.

Data from Coinglass has exposed that approximately $1.5 billion worth of long and brief ETH positions have actually been liquidated throughout the board over the previous 3 weeks. In the meantime, Ethereum has actually been secured a no-trade zone that is getting narrower gradually. The token's rate action has actually specified 2 crucial cost points that will likely identify where rates are heading next.

Ethereum has actually established a coming down triangle on its four-hour chart. This technical development dominates that a break listed below the X-axis or above the hypotenuse might lead to a 25% rate motion in either instructions. A continual close listed below $1,700 or above $1,900 will likely solve the uncertainty that ETH presently provides.

Dipping listed below assistance might lead to a scaling down towards $1,300, while getting rid of resistance may motivate sidelined financiers to return to the marketplace and push Ethereum approximately $2,270

Despite the uncertain technical outlook, on-chain information reveals that numerous big Ethereum whales are leaving their positions, suggesting worries of a more decrease.

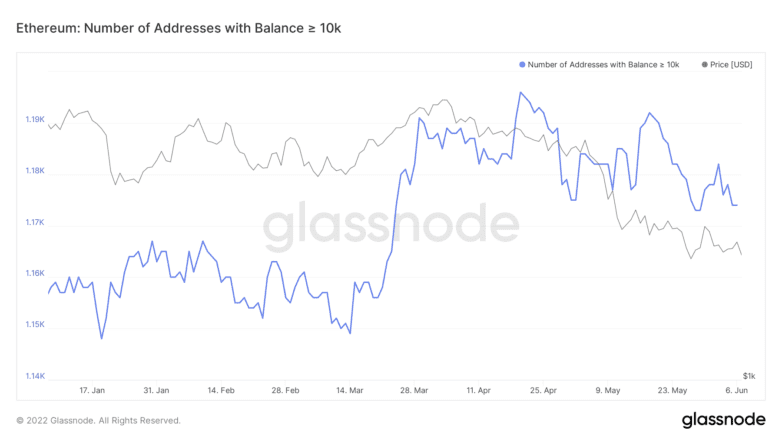

Data from Glassnode exposes that the variety of addresses with a balance higher than 10,00 0 ETH has actually decreased by 1.51% in the previous 3 weeks. Approximately 18 whales have either left the network or rearranged their holdings. This amount might appear irrelevant at very first glimpse, it is worth keeping in mind that each of these addresses held at least $20 million worth of ETH.

This increase in offering pressure from whales might be damaging Ethereum's capability to rebound. Still, a definitive four-hour candlestick close beyond the $1,700-$ 1,900 no-trade zone might assist figure out which instructions ETH will move over the coming weeks.

Disclosure: At the time of composing, the author of this piece owned BTC and ETH.

For more essential market patterns, register for our YouTube channel and get weekly updates from our lead bitcoin expert Nathan Batchelor.

The info on or accessed through this site is acquired from independent sources our company believe to be precise and trustworthy, however Decentral Media, Inc. makes no representation or guarantee regarding the timeliness, efficiency, or precision of any info on or accessed through this site. Decentral Media, Inc. is not a financial investment consultant. We do not offer tailored financial investment suggestions or other monetary suggestions. The details on this site goes through alter without notification. Some or all of the details on this site might end up being out-of-date, or it might be or end up being insufficient or incorrect. We may, however are not obliged to, upgrade any out-of-date, insufficient, or unreliable info.

You ought to never ever make a financial investment choice on an ICO, IEO, or other financial investment based upon the details on this site, and you must never ever analyze or otherwise depend on any of the details on this site as financial investment recommendations. We highly advise that you speak with a certified financial investment consultant or other competent monetary expert if you are looking for financial investment recommendations on an ICO, IEO, or other financial investment. We do decline payment in any type for evaluating or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or products.

Fidelity to Offer Ethereum Trading and Custody

Fidelity is likewise preparing to broaden its group of blockchain professionals. Long-Term Indicators Fidelity is preparing to use services for the custody and trading of Ethereum and other cryptocurrencies, according ...

Harbour Offers Institutional Liquid Staking on Ethereum

Two significant blockchain companies have actually revealed the launch of Harbour, a liquid staking procedure for the Ethereum blockchain. Harbour Is Now Live on Mainnet Blockdaemon and StakeWise released Harbour's mainnet ...

Ethereum's Bleed Against Bitcoin Dashes "Flippening" ...

Ethereum is having a difficult time recuperating from the current market downturn. Ethereum Slides Against Bitcoin Ethereum is dragging Bitcoin. The second-largest cryptocurrency by market cap is revealing weak point ...

Read More https://bitcofun.com/ethereum-primed-for-volatility-as-price-movements-tighten/?feed_id=26891&_unique_id=62c2ddb58c425

No comments:

Post a Comment