Major cryptoassets returned a few of their previous gains in early European trading on Friday after a strong over night session that briefly sent out bitcoin (BTC) above the USD 22,000 mark, assisted by enhancing danger belief on Wall Street on Thursday. Regardless of the losses in early trading, the coin stayed in favorable area for the past 24 hours.

At 13: 30 UTC, bitcoin stood at USD 21,366, up 5% for the past 24 hours and up 9% for the previous 7 days. ethereum (ETH) traded at USD 1,210, up 2% for the day and up a 15% for the week.

Friday's modest gains for the 2 biggest coins followed a strong day in the United States stock exchange on Thursday, when the broad S&P 500 index acquired some 1.5%, marking its 4th successive day of gains. At press time on Friday, nevertheless, the risk-on belief appeared to have actually compromised, with S&P 500 futures suggesting an opening 0.6% listed below the other day's closing cost.

Analysts at the crypto exchange Bitfinex stated in an emailed market commentary on Friday that,

" An intrinsic durability that cryptocurrency has actually shown in current weeks in the face of a wave of liquidations and solvency problems has actually come forward today as the marketplace gets in the green zone."

They included that "hedge funds banking on larger contagion and market capitulation" are now "licking their injuries" after gains for both BTC and ETH, and stated it will be fascinating to see if the crypto market can continue increasing this month.

" Bitcoin has actually been boosted by an increased cravings for threat, as evidenced by a four-day winning streak in the United States's S&P 500 where damaged innovation stocks have actually likewise rebounded," the experts stated.

' Massive deleveraging' primarily over

According to the widely known crypto supporter and CEO of Galaxy Digital, Mike Novogratz, the worst is most likely currently over for the crypto market, although he stated it might well be "slicing sideways for a while."

" We've had this huge deleveraging, and I believe the majority of that deleveraging is now out of the system," Novogratz stated throughout an interview on CNBC. He included that the marketplace "obviously" might go lower, however restated that "it seems like we're 90% through that deleveraging."

A comparable belief was likewise shared by Marcus Sotiriou, an expert at the digital possession broker GlobalBlock, who stated in an emailed commentary on Friday that the marketplace has actually lastly seen "some restored optimism."

The optimism followed peace of minds from crypto billionaire Sam Bankman-Fried and his business Alameda Research that they have "a couple of billion" offered to boost flagging crypto companies, with Sotiriou stating this might imply that the worst of the liquidity crisis lags us.

Still, it is something else that stays the most essential element for the rate of bitcoin, according to Sotiriou.

" The only Bitcoin bottom signal for me is relentless information revealing us that inflation is convincingly inflecting down. This ought to lead to the United States Federal Reserve ending up being less aggressive with their financial policy, and for that reason supply self-confidence that the liquidity crisis in the crypto market is over," he stated.

Positive outlook on-chain

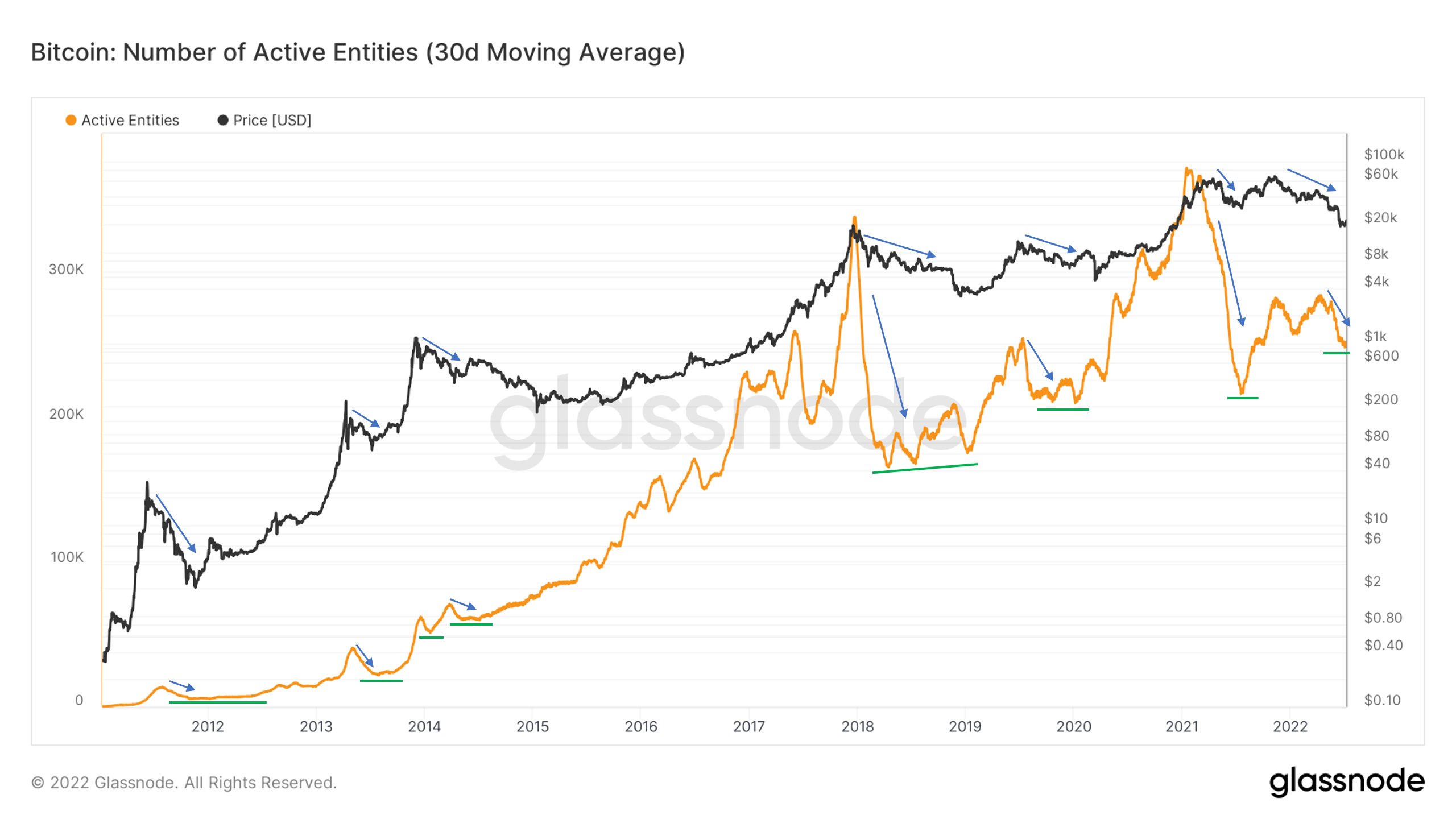

Analyzing the bitcoin market from an on-chain viewpoint, Will Clemente, Lead Insights Analyst at Bitcoin mining business Blockware Solutions, pointed to an increasing variety of active entities on the Bitcoin network as "the genuine signal" of adoption.

Sharing a chart of the variety of active entities, Clemente argued that,

" Every cost drawdown some brand-new market individuals leave (that were just here for rate increasing), however there's a greater base of individuals who acquire conviction in Bitcoin and remain."

Coinbase premium

Taking a various technique, Ki Young Ju, the CEO of crypto analysis site CryptoQuant.com, indicated the so-called Coinbase premium as one indication that the marketplace is beginning to see a "healing from contagion worry."

The Coinbase premium reveals the space in between the area cost of bitcoin on Coinbase versus on the competing crypto exchange Binance It is thought that because more organizations in the United States usage Coinbase to make their purchases, an increasing premium is an indication that American banks are building up bitcoin.

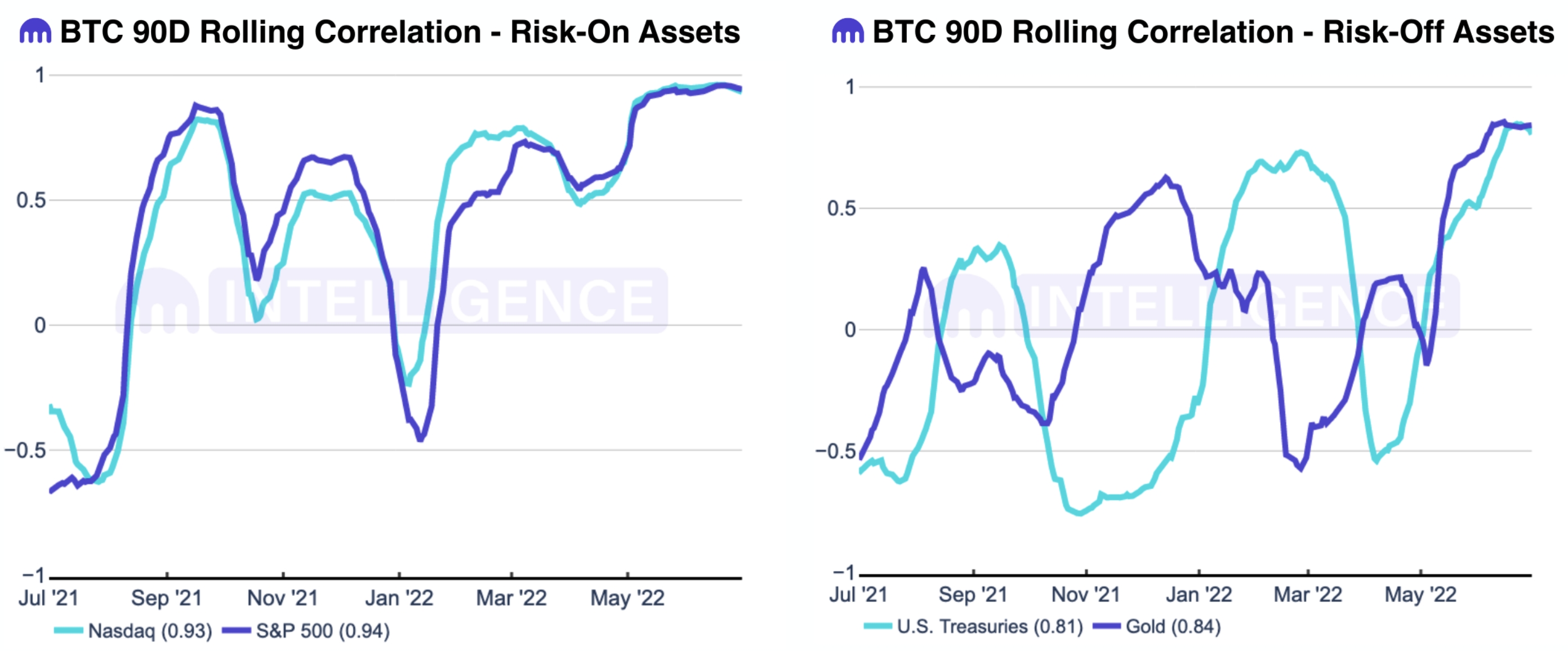

Increased connection with gold

Meanwhile, crypto exchange Kraken in its regular monthly market upgrade kept in mind that bitcoin and the United States stock exchange stayed favorably associated for the month of June, without any substantial modification in connection throughout the month.

And while the connection with stocks stayed the same, bitcoin's connection with the standard safe house and inflation hedge gold increased throughout the month.

The increased connection "indicates a wider pattern of connections in between all property classes increasing in the middle of considerable macroeconomic unpredictability," Kraken commented.

____

Read More https://bitcofun.com/experts-discuss-inherent-resilience-in-bitcoin-crypto-as-rally-fades/?feed_id=30743&_unique_id=62e668bb618bd

No comments:

Post a Comment