Cryptocurrencies

Cryptocurrencies  Op-Ed: Why crypto bailouts are a double-edged sword Shane Neagle · 2 hours earlier · 5 minutes read

Op-Ed: Why crypto bailouts are a double-edged sword Shane Neagle · 2 hours earlier · 5 minutes read

Crypto stemmed as a reaction of the 2008 international monetary crisis and its bailouts, however after more than a years of success things appear to have actually come cycle

Cover art/illustration by means of CryptoSlate

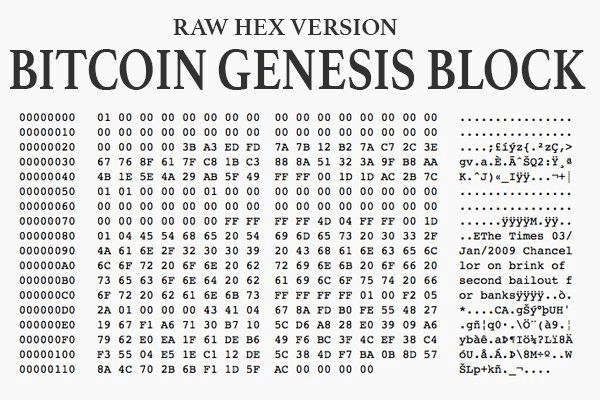

It appears we are coming cycle when it pertains to monetary contagion. Direct exposure to bad possessions-- mostly led by subprime home loans-- and derivatives activated the 2008 worldwide monetary crisis. The resulting bank bailouts to the tune of $500 billion were so questionable that Bitcoin's genesis block embedded an associated heading as a caution:

Fast forward to today, and Bitcoin has actually prospered in leading a decentralized motion of digital properties, which at one point had a market cap of more than $2.8 billion. Things have actually relaxed ever since, however it's clear that digital properties are here to remain.

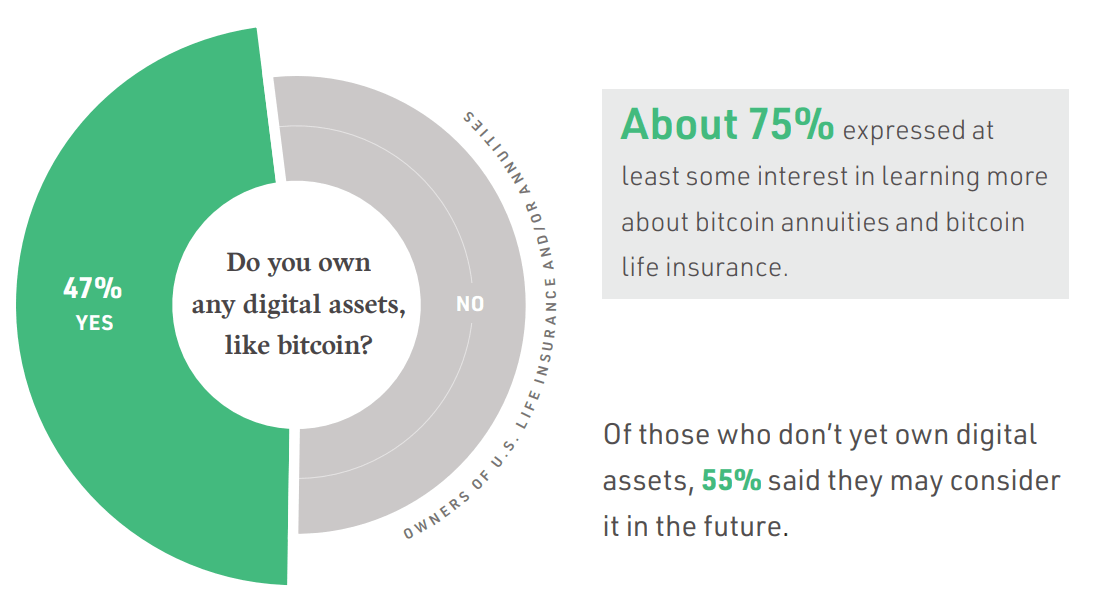

Bitcoin has actually seen unbelievable adoption, from legal tender to possibly being consisted of in life insurance coverage policies According to an NYDIG (New York Digital Investment Group) study performed in 2015, most of digital possession holders would check out such an alternative.

On this roadway to adoption, Ethereum was tracking behind Bitcoin, producing a community of dApps with its general-purpose wise agreements-- the structure for decentralized financing (DeFi) to change a lot of the procedures seen in conventional monetary.

dApps covered whatever from video gaming to financing and loaning. A monetary contagion sneaked in regardless of the automated and decentralized nature of Finance 2.0. The crisis of Terra (LUNA) was a crucial accelerator that continues to burn through the blockchain landscape.

Cryptocurrencies Terra's Fallout Still Ongoing

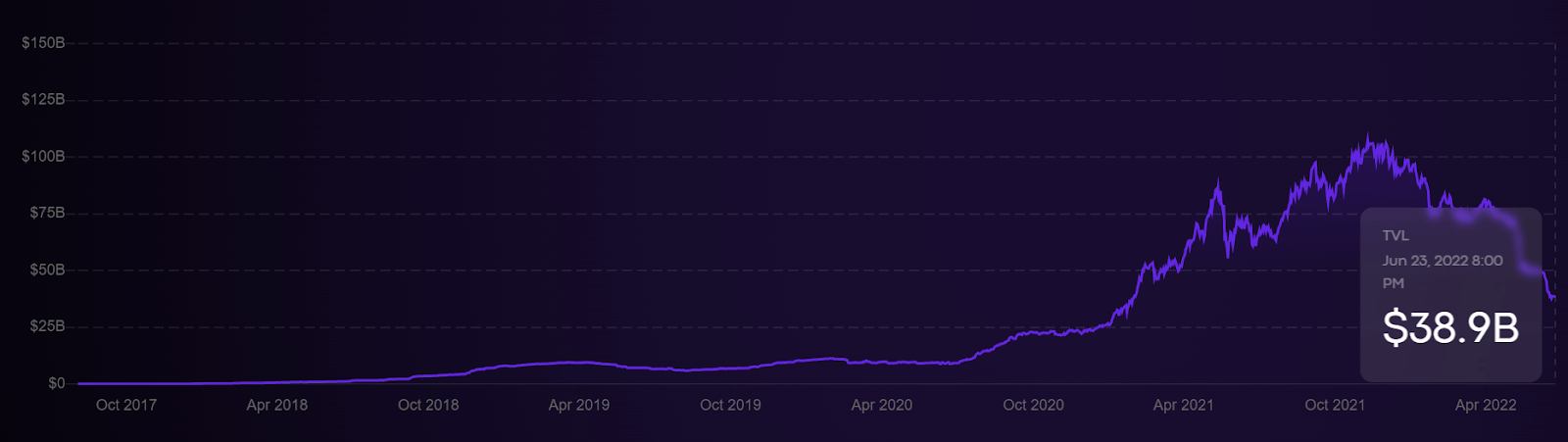

This previous May marked the biggest crypto wipeout in history, as shown by a TVL reset to levels not seen considering that January2021 By all looks, Terra (LUNA) was ending up being Ethereum's strong competitors, having e stablished a DeFi market cap share at 13% prior to its collapse-- more than Solana and Cardano integrated. Paradoxically, main banking is what eventually triggered the fire.

The Fed's rates of interest walkings activated market selloffs, guiding DeFi into bearish area. This bear took a swipe at LUNA's cost, which was collateralizing Terra's UST algorithmic stablecoin. With the peg lost, over $40 billion, in addition to Terra's high-yield staking platform Anchor Protocol, disappeared.

The disastrous occasion sent out shockwaves throughout the crypto area. It reached Ethereum (ETH), which was currently struggling with hold-ups with its extremely prepared for combine In turn, market individuals that count on direct exposure to both possessions, mainly through yield farming, got closer to insolvency much like Lehman Brothers carried out in 2008.

- Having depended on ETH liquid staking (stETH), Celsius Network closed down withdrawals The crypto loaning platform had $118 billion worth of AuM in May.

- Three Arrows Capital (3AC), a $10 billion crypto fund with direct exposure to both stETH and Terra (LUNA), is presently dealing with insolvency after $400 million in liquidations.

- BlockFi, a crypto loan provider comparable to Celsius however without its own token, ended 3AC positions

- Voyager Digital minimal everyday withdrawals to $10 k The crypto broker had actually lent a considerable quantity of funds to 3AC by means of 15,250 BTC and 350 million USDC.

As you can inform, when the domino effect begins, it produces a death spiral. For the time being, each platform has actually rather handled to create bailout offers. Voyager Digital struck a credit limit with Alameda Ventures worth $500 million to satisfy its clients' liquidity commitments.

BlockFi tapped the FTX exchange for a $250 million revolving credit line. In a more enthusiastic relocation, Goldman Sachs is supposedly aiming to raise $ 2 billion to get Celsius Network. There are 2 conclusions to draw from this mess:

- There is an industry-wide agreement that crypto is here to remain in regards to digital properties as such, derivatives trading, and wise agreement financing practices. Otherwise, the bailout interest would not have actually been so fast.

- DeFi roots have actually been upturned. We are now seeing restructuring and debt consolidation. To put it simply, we're seeing a growing application of centralization, be it by big exchanges or big industrial banks.

However, if the contagion continues in unexpected instructions in the middle of market selloffs, is it the location of the federal government to action in? Needless to state, this would break the really structure of cryptocurrencies, with the focus on "crypto".

Cryptocurrencies Even the IMF Wants Cryptos to Succeed

IMF president and WEF factor Kristalina Georgieva kept in mind at a Davos Agenda conference in May 2022 that it would be an embarassment if the crypto environment were to stop working:

" It provides all of us faster service, much lower expenses, and more addition, however just if we different apples from oranges and bananas,"

Recently, the United States Securities and Exchange Commission (SEC) commissioner Hester Peirce concurred with that latter part. She kept in mind that crypto wheat requires to be cut off from the chaff.

" When things are a bit harder in the market, you find who's really constructing something that may last for the long, longer term and what is going to die."

She is not just referencing challenges if platforms stop working however work layoffs and freezes. The previous couple of weeks were swamped with crypto layoffs from all corners of the world: Bitpanda scaled down by about 270 workers, Coinbase by 1,180(18% of its labor force), Gemini by 100, and Crypto.com by 260, to call simply a couple of.

In the meantime, Sam Bankman-Fried, the CEO of FTX, sees it as his responsibility to assist the establishing crypto area himself. The crypto billionaire believes that birth crypto discomforts are inescapable provided the liabilities enforced by main banking.

" I do feel like we have an obligation to seriously think about stepping in, even if it is at a loss to ourselves, to stem contagion,"

This does not just use to Fed-induced possession recalibration however to brute hacks. When hackers drained pipes $100 million from the Japanese Liquid exchange in 2015, SBF actioned in with a $120 million refinancing offer, ultimately obtaining it entirely.

Additionally, it bears remembering that lots of standard stock brokers such as Robinhood likewise accepted digital possessions. Today, it isn't simple to discover a popular stock broker that does not provide access to pick digital possessions. The forces that have actually purchased the crypto environment far surpass periodic missteps under severe market conditions.

Cryptocurrencies Bailout Evolution: From Big Government to Big Money

At the end of the line, one needs to question if DeFi as such is a pipedream. For something, it is challenging to state that any financing platform is really decentralized. For another, just central leviathans hold deep liquidity to hold up against prospective market tension.

In turn, individuals rely on those organizations as "too huge to stop working", as decentralization fades in the rearview mirror. This uses similarly to FTX and Binance, simply as it uses to Goldman Sachs. The bright side is that effective organizations, from WEF to big crypto exchanges and even enormous financial investment banks, desire blockchain possessions to be successful.

These bailouts and prospective acquisitions definitely confirm the tech and abilities that are driving digital possessions-- however they might wind up being an action in the incorrect instructions in regards to decentralization.

Read More https://bitcofun.com/op-ed-why-crypto-bailouts-are-a-double-edged-sword/?feed_id=26435&_unique_id=62bea8f3ec209

No comments:

Post a Comment