Unstoppable Domains is a crypto domain registrar where users can develop non-censorable sites saved in the owner's crypto wallet.

Unstoppable domains work similar to your standard domain, hosting a site to offer an item, notify an audience, or anything else you wish to utilize it for. They likewise let users create a universal username, log in to the decentralized web, and work as a crypto wallet, keeping cryptocurrency sent out by visitors and purchasers.

Each domain is developed on blockchains such as Ethereum, Polygon Zilliqa, and numerous others, with a variety of domain extensions such as.crypto and.zil.

In this guide, we'll cover whatever you require to learn about Unstoppable Domains, consisting of, what Unstoppable Domains are, how they work, the advantages and disadvantages of Unstoppable Domains, and how you can purchase and offer one in 2022, domain security, and future of Unstoppable Domains.

About Unstoppable Domains

Unstoppable Domains is a domain registrar that offers decentralized domains( likewise called crypto domains) that use numerous benefits over conventional web 2.0 options.

Instead of utilizing standard domain innovation (DNS), Unstoppable Domains utilizes blockchain innovation and is referred to as a crypto name service (CNS). Here are a few of the advantages.

Firstly, Unstoppable Domains lets users own the domains they buy. Typically, domain registrars such as GoDaddy and Namecheap would lease domain to users for a month-to-month or annual cost; nevertheless, they would still have complete ownership. With Unstoppable Domains, a single in advance payment is made, and complete ownership is moved to the purchaser.

This has numerous fringe benefits. The purchaser now has complete ownership of the domain, and their material can't be censored. Historically, domain companies and online search engine such as Google would have the power to eliminate your website needs to you publish anything not following their terms.

As an Unstoppable Domains domain owner, you have total independent control of the domain, indicating you can utilize it nevertheless you desire rather of complying with online search engine.

When signing up, you'll have an option of different extensions, including.crypto,. zil,. wallet, and.nft, enabling you to select the extension based upon your task. If you've set up a DAO (decentralized self-governing company), you can pick Project name *. dao. As soon as signed up, your information will be on a public blockchain rather of kept on a personal database owned by a DNS service provider.

After signing up, you can modify, move or connect your domain to any crypto service you desire, and Unstoppable Domains will never ever interfere.

Using your domain, you can likewise access sites on Opera and Brave internet browsers with an automated DNS modification in Chrome or through the Unstoppable extension offered on Chrome, Firefox, and Edge.

Who Are Unstoppable Domains For?

Now, you may be asking yourself, should I purchase an Unstoppable Domain? And the response is it depends (though we absolutely will be!)

There are a couple of factors an Unstoppable domain might be for you.

Firstly, if you wish to own your domain rather of leasing it from a domain service provider, not just does this exercise more affordable (the average Unstoppable Domain costs around $20), however it likewise provides you complete comfort that the domain is yours and no one can take that from you.

Secondly, if you utilize crypto and desire access to the decentralized web. Web 3.0 is ending up being a popular choice among web users who wish to trade cryptocurrency and keep their information far from big corporations. An Unstoppable Domain will double down as your crypto wallet and offer you access to web 3.0 without requiring extensions.

Thirdly, if you simply wish to make a great financial investment. Given That 2021 crypto domains have actually considerably grown in appeal, with over 1.4 million ". eth" domains signed up. This is a substantially smaller sized number than the 359.8 million signed up domain names, crypto domains are ending up being more popular and offering for the greatest costs because the crypto domain rate peak in 2017.

If you're a company owner on the fence about whether to purchase, then doing something about it might not be a bad concept. As crypto domains continue to grow in appeal, their general rates will increase too. Purchasing now might indicate you bag a deal and permit simple crypto deals in the future.

Instead of requiring to send out a complex code, your Unstoppable domain can function as your wallet, accepting over 280 crypto-related possessions with the sender just requiring your domain. Your domain can then path the payment to your crypto wallets.

How Much are Unstoppable Domains?

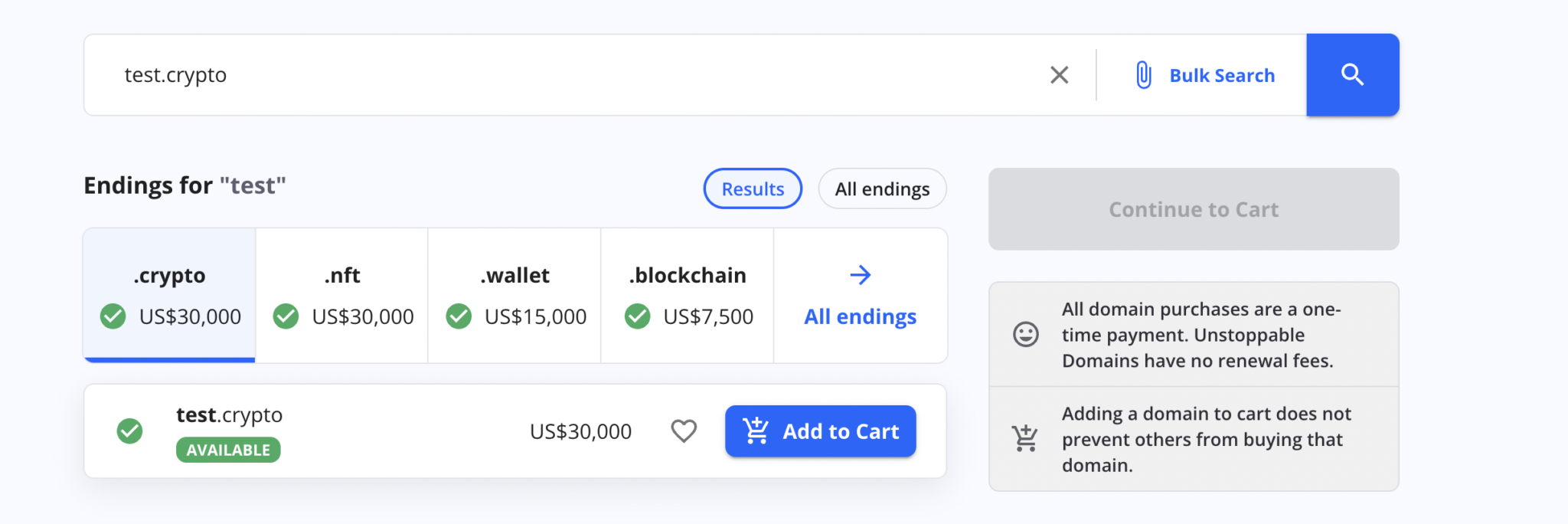

Your domain's overall expense depends upon the approximated worth of the domain and the gas charges at the time of your deal. When these have actually been paid, you'll never ever need to pay a renewal cost.

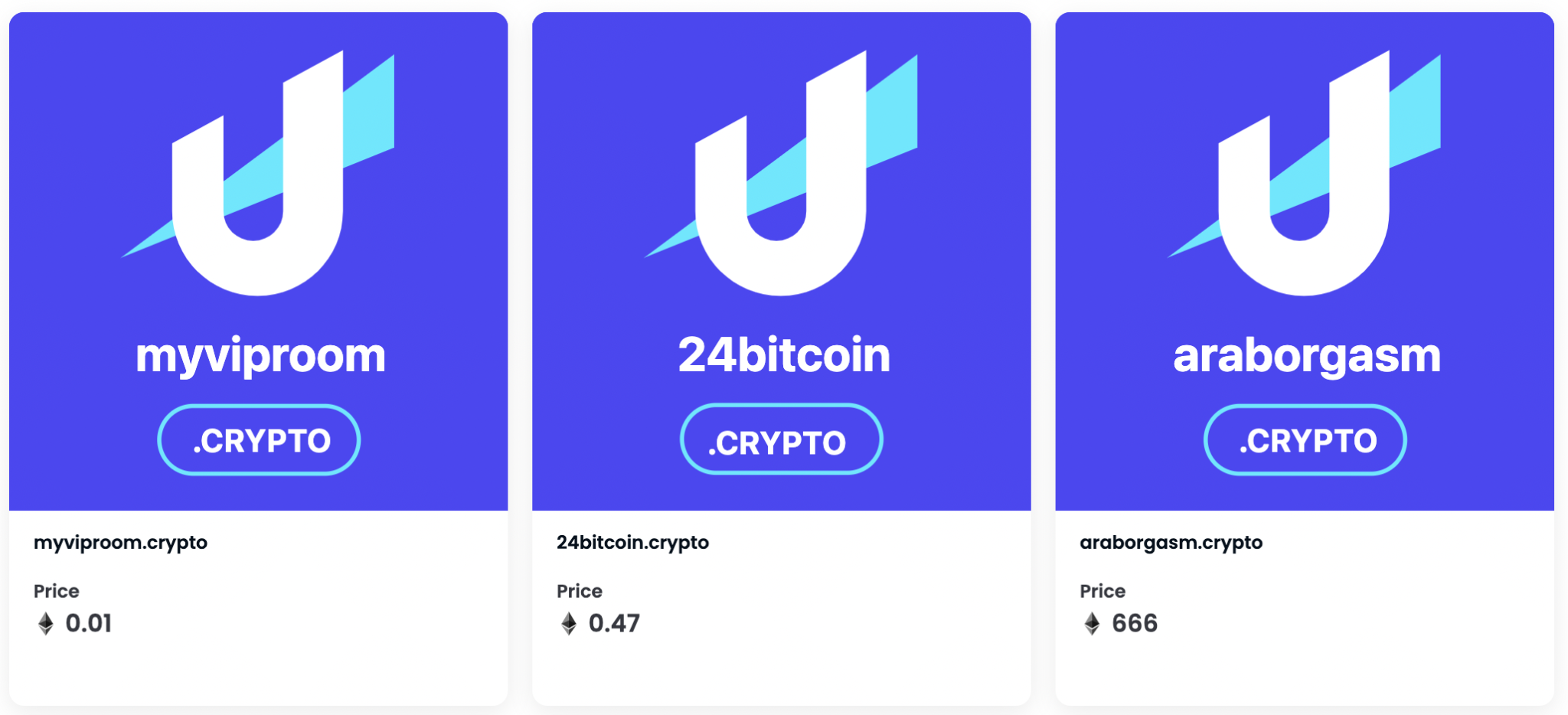

Domains themselves can vary from $20 to over $1000 Picking a popular word will likely increase the expense, and.crypto domains tend to cost more than.wallet or.dao choices. The much shorter the domain, the more costly it will be.

Unstoppable Domains have actually likewise launched premium domains that can cost upwards of $10,000

The 2nd aspect is the gas costs (deal charge), as domains are kept on the Ethereum blockchain. As soon as acquired, you'll require to declare your domain on the blockchain, which will differ in expense based upon the Ether (ETH) cost and the network blockage at the time. This normally costs around $50 though it will differ with market variations.

Should You Replace Your Domain With An Unstoppable Domain?

Although crypto domains are growing in appeal, it's crucial not to get ahead of yourself. There's being early to the celebration, and after that there's being a little too early. Rather, it might be a great time to keep your standard domain running and purchase an Unstoppable domain for future usage.

As each domain utilizes various innovation, you will not have the ability to upgrade them all at once (though if there are any blockchain contractors reading this, this might be a big chance!) As an outcome, attempting to handle both might be quite lengthy.

Nonetheless, as web 3.0 continues to grow, the value of owning a crypto domain will likewise increase, specifically if web 3.0 ends up being the brand-new standard.

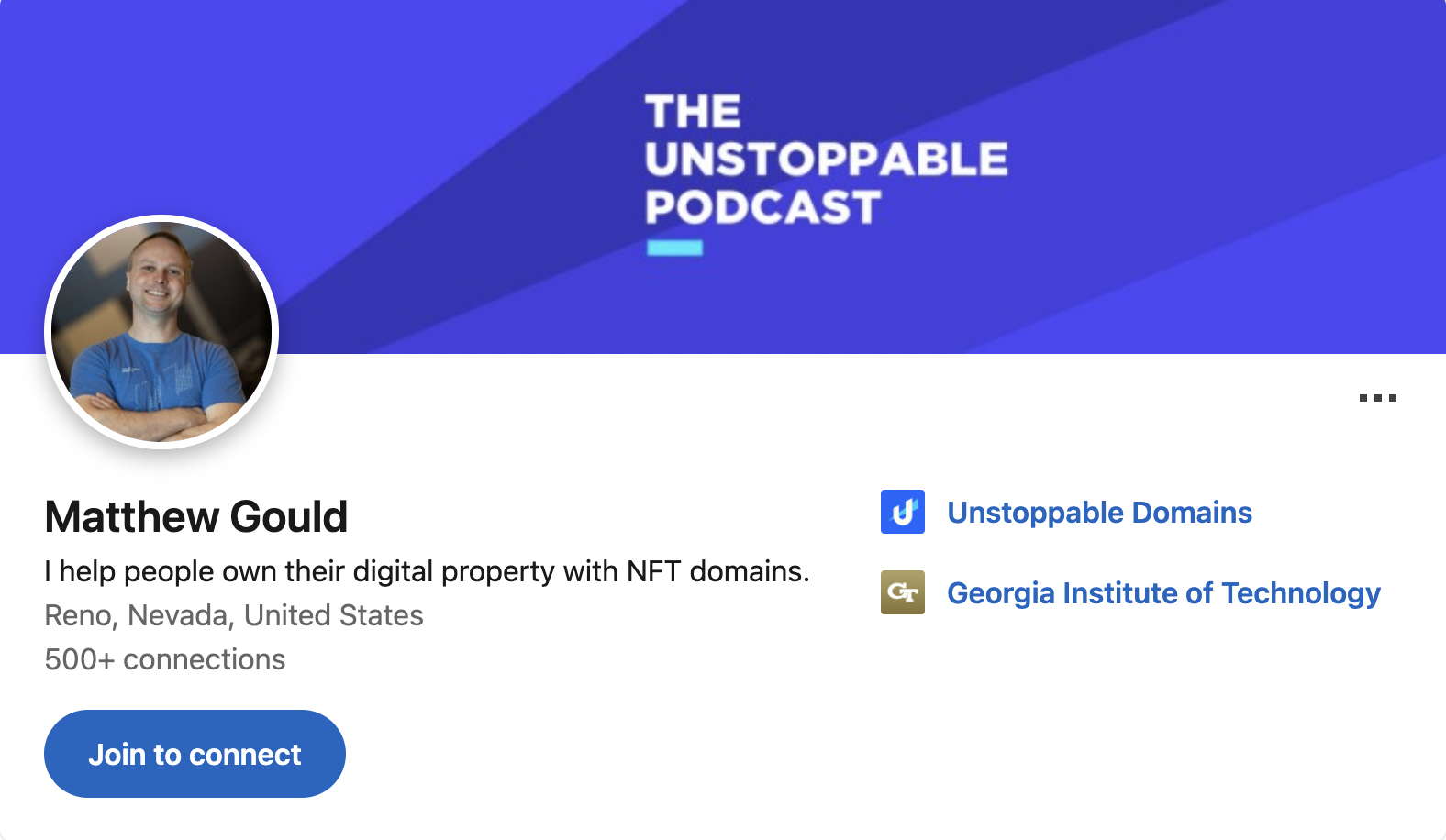

Who Founded Unstoppable Domains

Unstoppable Domains is a San Francisco-based business established in 2018 by Matthew Gould and Bogdan Gusiev. Developed as a link in between web 2.0 and web 3.0, it moved completely into web 3.0.

Before beginning Unstoppable Domains, Matthew (CEO) was a serial business owner, constructing the very first customer score system on Bitcoin, and Verified News, an Ethereum app that verifies how sincere newspaper article are on the blockchain. Matthew officially operated at YC start-up, Talkable and assisted the business grow from simply 5 to over 50 staff members. Another among his business, Browseth, was just recently granted a grant from the Ethereum Foundation to construct a front-end library for Ethereum advancement. Matthew is likewise a coach with the ENS structure, which assists to develop the procedure layer for blockchain-based domains constructed on Ethereum.

Bogdan (CTO) originated from a software application background and worked from a junior designer to CTO in just 11 years. He works as an open-source designer and Kiev Ruby neighborhood member.

Pros and Cons of Unstoppable Domains

The idea of a crypto domain might appear a little frustrating at first, and it assists to comprehend the advantages and detractions of this unique innovation.

Pros

You Have Full Ownership

Unlike your.com options, which go through legal jurisdiction and elimination, your Unstoppable domain will be signed up on a public blockchain, and you will have complete ownership. This indicates you're not at threat of being censored.

Single Purchase

Tired of unanticipated renewal charges? Unstoppable Domains declares to eliminate them totally. With a single, one-time purchase, the domain will be yours permanently without requiring to pay renewal charges. This is due to the fact that domains work like an NFT, which will be kept in your wallet as evidence of ownership.

Customization

Being the total owner of the domain implies you can do with it as you please. You can select any style, style, or material you desire. You can select to move it for an earnings, which is substantially more difficult to do with a standard domain.

Works As A Crypto Wallet

If you run an organization that accepts cryptocurrency (or strategy to), then your Unstoppable Domain will likewise work as a crypto wallet for you to accept payments. Since July 2022, over 280 kinds of cryptocurrency are supported.

Support for dApps

Unstoppable Domain sites natively support decentralized apps, which implies they can be executed and utilized without requiring any extensions.

High Security

Blockchain innovation is popular for its high level of security. Due to the nature of your website, cyber-attacks on your domain are practically difficult, providing you assurance that your website is safe from hackers.

Cons

Risk Of Not Becoming Mainstream

Crypto domains are still a reasonably brand-new idea, with the typical web user not understanding anything about them. As an outcome, there's no chance to understand whether the mainstream market will embrace unstoppable Domains.

Not Fully Supported On Browsers

As of July 2022, Unstoppable Domains is rather restricted concerning internet browser assistance. Domains are accepted on web internet browsers such as Brave and Opera, nevertheless, internet browsers like Chrome, Firefox, and Edge need DNS adjustments to access them. Unstoppable Domains have actually created a totally free internet browser extension to fix this, though this is still a small trouble.

Web Hosting Isn't Practical

The procedure is a little complex if you wish to host your basic site on your Unstoppable domain. You'll require a decentralized peer-to-peer facilities for hosting, such as IPFS.

Public Perception

Although Unstoppable domains are basically the like standard domains, lots of people still think the website is just for crypto services. This returns to our very first con, as it postpones the mainstream adoption rate.

How To Buy An Unstoppable Domain

Buying an unstoppable domain is quite easy and works the exact same method as minting an NFT. If this sounds complicated, do not fret. It's a lot easier than it sounds.

To start, follow these actions or have a look at our guide on How To Buy A Crypto Domain for a more comprehensive summary.

- Head over to https://unstoppabledomains.com/

- Sign in or develop your account.

- Use the search bar on top to look for the domain you wish to purchase.

- Add the domain to your cart and checkout.

- You can pay with Credit Card, PayPal, and Crypto.

- You'll be sent out an e-mail to validate your identity.

- Once validated, you can declare your domain by picking a wallet address.

- Claim this with your wallet, and you'll now own your domain.

After declaring your domain, you can connect your cryptocurrency addresses. If you connect your Ethereum address, individuals can send out ETH to your Unstoppable domain rather of the numerical Ethereum address.

How To Sell Your Unstoppable Domain

So you've purchased a crypto domain however chose you wish to offer. There are 2 methods to do this; through the Unstoppable Domains site or through external markets such as OpenSea

On Unstoppable Domains, head over to Manage for your minted domain, choose Contact, and include your e-mail address.

Then click Sell Domain and conserve the modifications.

This will show a "For sale by owner" tag beside your domain on the website, enabling users to email you to ask.

Another method to offer your domain is through a third-party market such as Opensea or Mintable. To do this, follow our guide on how to offer your crypto domain in 7 simple actions.

Are Unstoppable Domains Safe?

Unstoppable domains are exceptionally safe and probably much safer than their standard options. When you declare the domain, it's signed up under your address on the blockchain. This indicates no one can hack your domain unless they hack the blockchain (which is practically difficult).

In addition, no 3rd party has the power to eliminate or censor your domain, implying it's never ever at threat of being down due to censorship.

To prevent frauds, acquire your domain straight on the Unstoppable Domains site or through the main page for Unstoppable Domains on websites such as Opensea.

Final Thoughts Unstoppable Domains and the Future Of Domain Registrars

Unstoppable Domains utilizes the blockchain to bring the complete power of domain ownership to individuals for the very first time considering that the web was developed.

Although still a fairly brand-new idea, ownership and the worth of crypto domains are on the increase. As more individuals check out crypto domains, crypto domain registrars such as Unstoppable Domains and ENS ( Ethereum Name Service) stay at the leading edge of Web 3.0 domain advancement, producing a friendlier method for individuals to own and trade crypto.

However, the platform stays rather misconstrued by the public. With many individuals thinking it's entirely for crypto-related tasks, mainstream adoption has actually slowed. Should you purchase an Unstoppable Domain?

As cryptocurrency and crypto domains continue to affect society, the worth of crypto domains will likely escalate as more domains are taken. It's difficult to forecast the future of cryptocurrency, it's hard to disregard the introduction of crypto domains and the methods blockchain innovation can affect how we utilize the web.

Cryptocurrencies

Cryptocurrencies

This is a viewpoint editorial by Mickey Koss, a West Point graduate with a degree in economics. He invested 4 years in the infantry prior to transitioning to the Finance Corps.

This is a viewpoint editorial by Mickey Koss, a West Point graduate with a degree in economics. He invested 4 years in the infantry prior to transitioning to the Finance Corps.