Olga Ortega, the co-founder and CPO of the real-time DeFi explorer AnalytEx by HashEx

_______

Currently, there are numerous decentralized procedures and their usage cases, and not everybody is skilled in the terms of DeFi to begin dealing with procedures immediately. It needs a specific level of understanding-- that is why today we begin with determining what a liquidity swimming pool or a farm is.

What is a Liquidity Pool?

A trading set of tokens with locked funds from liquidity companies is called a Liquidity swimming pool. Liquidity swimming pools are the structure of DeFi. Positioning 2 tokens into a liquidity swimming pool, financiers develop an LP token and get earnings from all swaps made in between these 2 tokens on a procedure. Let's think about SushiSwap

In the liquidity menu product, by clicking the swimming pool alternative, we can include 2 tokens and develop an LP token.

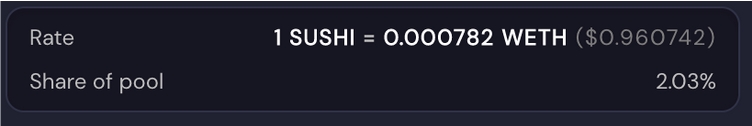

To produce an LP token with a set of ETH/ SUSHI you need to have both properties in your wallet.

Once produced, you can just keep your LP token in your wallet and make some earnings that depends on your share of the liquidity swimming pool of this trading set.

At the time of composing, the LP token including 1 ETH and 1278.9 SUSHI is just 2.03% share of this liquidity swimming pool.

Also, you can position your LP token into a Farm to begin making passive earnings.

What is a Farm?

A clever agreement in which you can stake both LP tokens and solo tokens in order to get earnings in tokens of the procedure you are utilizing is called a Farm since all these swimming pools are managed with a MasterChef Farm clever agreement. According to AnalytEx information, more than 1,000 clever agreements with the signature of MasterChef are developed monthly, which are normally called Farms for brief.

To put it simply, if you have an earnings in tokens of utilized procedure, no matter whether you put an LP token (a set of tokens) or a routine token into a clever agreement, all of this comes from the MasterChef agreement and must be called a Farm

Let's take a look at the sushi swap user interface:

We can see various sets of tokens that form LP tokens, positioning which in the MasterChef agreement of Sushiswap, you will get a token of this procedure - SUSHI.

For example, if you put your LP token, including FRAX and WETH sets, in SushiSwap, you will get a token of this procedure called SUSHI. At the exact same time, the financier will get a double benefit, for staking the LP token in SushiSwap Farm (MasterChef), and for offering liquidity in the FRAX/WETH set.

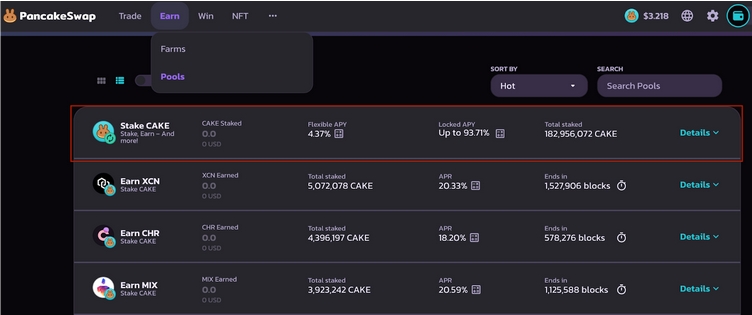

We observe the very same circumstance on other procedures, for instance, PancakeSwap - we can stake the LP token and get CAKE - the token of this procedure.

Where is the misconception?

In the Pools tab (called Syrup swimming pools), which practically all procedures different from farms, we see a swimming pool in which you can stake CAKE in order to get CAKE, however above we talked about that if you are rewarded in tokens of the procedure you utilize, you utilize the MasterChef agreement of that farm, despite whether the LP is tokens or solo. It would be more right to put this swimming pool in the Farms tab.

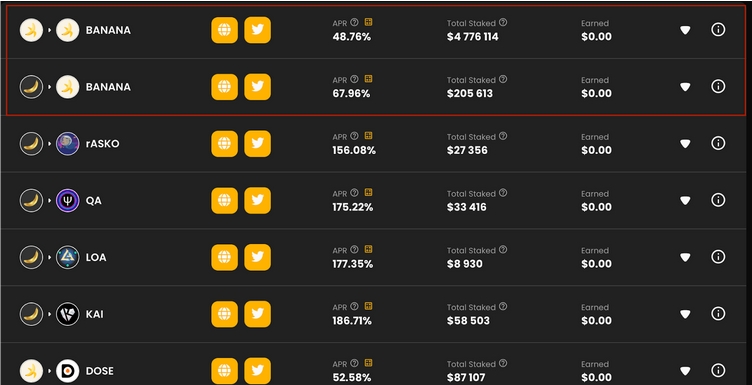

A comparable circumstance we can see in ApeSwap procedure. Here are BANANA farms. BANANA is the primary token of ApeSwap procedure.

However, in the Pools tab (called Staking swimming pools) there are 2 swimming pools associated to the ApeSwap farm master chef agreement.

According to AnalytEx, the master chief consists of 123 swimming pools in ApeSwap Protocol.

They are all called (Farm) swimming pools since they are all associated to the ApeSwap MasterChef agreement.

What are Staking/Syrup Pools?

Staking or syrup swimming pools are the kind where you can stake a routine token (normally a procedure token) into a clever agreement to make other tokens. Users pay interest to promise their tokens to the network to offer security on proof-of-stake blockchains.

For example, on ApeSwap, you can stake BANANA tokens to make different tokens. Staking and syrup swimming pools are 2 names for the very same thing on various procedures.

As a guideline, most understood procedures do not discuss the distinction in between Farm swimming pools and Staking/Syrup swimming pools and divide farming chances according to the requirement of tokens positioned in a wise agreement. If we are discussing LP tokens, the typically used term is "farms", however if it has to do with a solo token, it gets called "( staking/ syrup) swimming pool".

To conclude

From whatever we covered above, it can be concluded that, normally, if you get earnings in tokens of the procedure that you utilize, you are accessing the MasterChef agreement of this procedure. Despite whether you utilize LP tokens or solo tokens for staking. Such swimming pools can be called "Farm Pools" for benefit.

If you utilize solo tokens and get a benefit in some other tokens, you utilize third-party wise agreements. They are called "Staking" or "Syrup" swimming pools.

There are Liquidity Pools, Farm Pools, Staking/Syrup Pools, Lending Pools (connecting to Lending procedures).

Read More https://bitcofun.com/what-are-pools-and-farms-of-defi-protocols/?feed_id=35255&_unique_id=631002f972f02

No comments:

Post a Comment