Key Takeaways

- Ethereum's upgrade to Proof-of-Stake has actually stimulated issues over the network's resiliency versus 51% attacks.

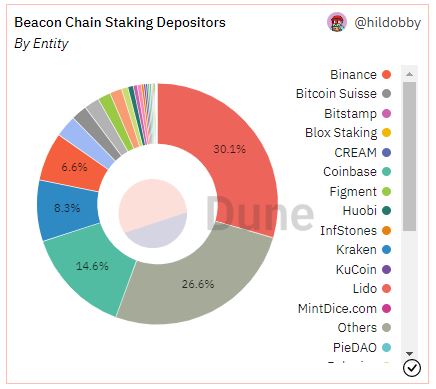

- The leading 4 staking entities represent 59.6% of the overall staked ETH.

- However, user-activated soft forks (UASFs) make sure that bad stars can not take control of the network, no matter how huge their stake.

Proof-of-Stake critics have actually sounded the alarm on Ethereum's brand-new Proof-of-Stake agreement system, declaring it makes the network prone to hostile network takeovers. Ethereum's brand-new system includes a failsafe to alleviate this danger and permits users to burn the funds of any opponent trying to take control of the blockchain.

Ethereum's Vulnerability to 51% Attacks

Ethereum's current switch far from Proof-of-Work has actually raised concerns about the network's capability to ward off attacks.

On September 15, Ethereum effectively updated its agreement system to Proof-of-Stake. To name a few things, the occasion, now understood in the crypto neighborhood as the "Merge," passed block production responsibilities from miners to validators. Contrary to miners, which utilize specialized hardware, validators just require to stake 32 ETH to get the right to procedure deals.

However, some crypto neighborhood members have actually fasted to explain that the majority of Ethereum's confirming power is now in the hands of simply a couple of entities. Information from Dune Analytics show that Lido, Coinbase, Kraken, and Binance represent 59.6% of the overall staked ETH market share.

This high concentration of staking power has actually raised issues that Ethereum might be susceptible to 51% attacks-- a term utilized in the crypto area to designate a hostile takeover of a blockchain by an entity (or group of entities) in control of most of block processing power. To put it simply, the concern is that big staking entities might conspire to reword parts of Ethereum's blockchain, alter the buying of brand-new deals, or censor particular blocks.

The possibility of a 51% attack ended up being especially significant after the U.S. federal government's restriction on Tornado Cash. On August 8, the U.S. Treasury Department included personal privacy procedure Tornado Cash to its sanctions list, arguing cybercriminals utilized the crypto job for money-laundering functions. Coinbase, Kraken, Circle, and other central entities rapidly adhered to the sanctions and blacklisted Ethereum addresses related to Tornado Cash. What would avoid these business from utilizing their staking power to censor deals on Ethereum's base layer if the Treasury bought them to?

As Ethereum developer Vitalik Buterin and other designers have argued, the network still has an ace up its sleeve: the possibility of executing user-activated soft forks (UASFs).

What Is a UASF?

A UASF is a system by which a blockchain's nodes trigger a soft fork (a network upgrade) without requiring to acquire the normal assistance from the chain's block manufacturers (miners in Proof-of-Work, validators in Proof-of-Stake).

What makes the treatment remarkable is that soft forks are typically set off by block manufacturers; UASFs, in impact, wrest control of the blockchain from them and briefly hand it over to nodes (which can be run by anybody). To put it simply, a blockchain neighborhood has the choice of upgrading a network's software application no matter what miners or validators desire.

The term is normally connected with Bitcoin, which especially activated a UASF in 2017 to require the activation of the questionable SegWit upgrade. Ethereum's Proof-of-Stake system was developed to allow minority-led UASFs particularly to battle versus 51% attacks. Need to an assaulter effort to take control of the blockchain, the Ethereum neighborhood might merely activate a UASF and ruin the whole of the destructive star's staked ETH-- lowering their verifying power to absolutely no.

In reality, Buterin has declared that UASFs make Proof-of-Stake much more resistant to 51% attacks than Proof-of-Work. In Proof-of-Work, opponents just require to obtain most of the hashrate to take control of the blockchain; doing so is expensive, however there is no other charge besides that. Bitcoin can alter its algorithm to render a few of the opponent's mining power worthless, however it can just do so when. On the other hand, Proof-of-Stake systems can slash an enemy's funds as often times as required through UASFs. In Buterin's words:

" Attacking the chain the very first time will cost the aggressor numerous countless dollars, and the neighborhood will be back on their feet within days. Assaulting the chain the 2nd time will still cost the aggressor numerous countless dollars, as they would require to purchase brand-new coins to change their old coins that were burned. And the 3rd time will ... expense much more countless dollars. The video game is really uneven, and not in the enemy's favor."

Slashing Is the Nuclear Option

When asked whether Coinbase would ever (if asked by the Treasury) utilize its confirming power to censor deals on Ethereum, Coinbase CEO Brian Armstrong mentioned that he would rather "concentrate on the larger image" and close down the exchange's staking service. While there's little factor to question the genuineness of his response, the possibility of a UASF most likely contributed in the formula. Coinbase presently has more than 2,023,968 ETH (roughly $2.7 billion at today's rates) staked on mainnet. The exchange's whole stack might be slashed if it attempted censoring Ethereum deals.

It's essential to keep in mind that slashing is not Ethereum's only alternative in case of a harmful takeover. The Ethereum Foundation has actually suggested that Proof-of-Stake likewise enables truthful validators (significance validators not trying to assault the network) to "keep structure on a minority chain and overlook the assaulter's fork while motivating apps, exchanges, and swimming pools to do the very same." The assaulter would keep their ETH stake, however discover themselves locked out of the appropriate network moving forward.

Finally, it's worth discussing that Ethereum's staking market isn't rather as central as it might at first appear. Lido, which presently processes 30.1% of the overall staked ETH market, is a decentralized procedure that utilizes over 29 various staking company. These specific validators are the ones in control of the staked ETH-- not Lido itself. Hence, collusion in between significant staking entities would be far more tough to arrange than it would at first appear.

Disclaimer: At the time of composing, the author of this piece owned BTC, ETH, and a number of other cryptocurrencies.

The details on or accessed through this site is gotten from independent sources our company believe to be precise and trustworthy, however Decentral Media, Inc. makes no representation or guarantee regarding the timeliness, efficiency, or precision of any details on or accessed through this site. Decentral Media, Inc. is not a financial investment consultant. We do not offer tailored financial investment recommendations or other monetary guidance. The info on this site goes through alter without notification. Some or all of the info on this site might end up being out-of-date, or it might be or end up being insufficient or unreliable. We may, however are not bound to, upgrade any out-of-date, insufficient, or unreliable info.

You ought to never ever make a financial investment choice on an ICO, IEO, or other financial investment based upon the info on this site, and you need to never ever translate or otherwise depend on any of the details on this site as financial investment suggestions. We highly suggest that you speak with a certified financial investment consultant or other competent monetary expert if you are looking for financial investment suggestions on an ICO, IEO, or other financial investment. We do decline settlement in any kind for evaluating or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or products.

See complete terms

We 'd Rather Stop Staking Than Censor Ethereum: Coinbase CEO

Coinbase CEO Brian Armstrong has actually chimed in on continuous disputes surrounding Ethereum's capability to stay censorship resistant under Proof-of-Stake. Coinbase Wouldn't Censor Ethereum If Coinbase was required to pick in between ...

Will Ethereum Be Vulnerable to Censorship After the Merge?

With the upgrade to Proof-of-Stake quickly approaching, the Ethereum neighborhood is discussing whether the current sanctions versus Tornado Cash might wind up threatening the blockchain itself. Combine Hype Overshadowed by ...

" A Major Policy Issue": Circle CEO Criticizes Tornado Cash Sanctio ...

Circle rapidly adhered to the U.S. Treasury's choice to sanction Tornado Cash, however its CEO is contacting market leaders to develop a privacy-enabling policy structure. Circle CEO Comments on ...

Read More https://bitcofun.com/what-prevents-large-validators-from-taking-over-ethereum/?feed_id=40407&_unique_id=63356a68636d0

No comments:

Post a Comment