This is a viewpoint editorial by Kudzai Kutukwa, an enthusiastic monetary addition supporter who was acknowledged by Fast Company publication as one of South Africa's top-20 young business owners under 30.

This is a viewpoint editorial by Kudzai Kutukwa, an enthusiastic monetary addition supporter who was acknowledged by Fast Company publication as one of South Africa's top-20 young business owners under 30. There is a fight going on the planet today that is mainly concealed from the public's view. This is not a fight in between nation-states, ethnic groups or spiritual enthusiasts contesting resources and areas. 2 financial systems are on a clash, each with its own unique ideology and worths. One system is a tool for monetary enslavement, and the other, for monetary flexibility. It's a fight that not just needs our attention, however our active involvement. It's the fight for the future of cash: bitcoin versus fiat.

Over the last 2 years, we saw the greatest infringement on our flexibilities by The State on an international scale. Medical martial law was let loose on the world which squashed organizations and damaged incomes; the keyboard believed authorities in the kind of " fact-checkers" were released to implement the state's sole story of occasions with alternative point of views being identified "harmful false information" and censored. Millions more were pushed into taking the COVID-19 vaccine due to the fact that their incomes were on the line, while totally neglecting their private threat profile, religions and individual choices.

The media cheered on these gross human rights infractions and gaslit everybody while shouting popular mottos like "we're all in this together" and "it's simply 15 days to slow the spread." In other words, take one for the group. Those that attempted to object versus these heavy-handed steps like the Canadian truckers did, had their checking account frozen at the drop of a hat and ended up being victims of monetary censorship.

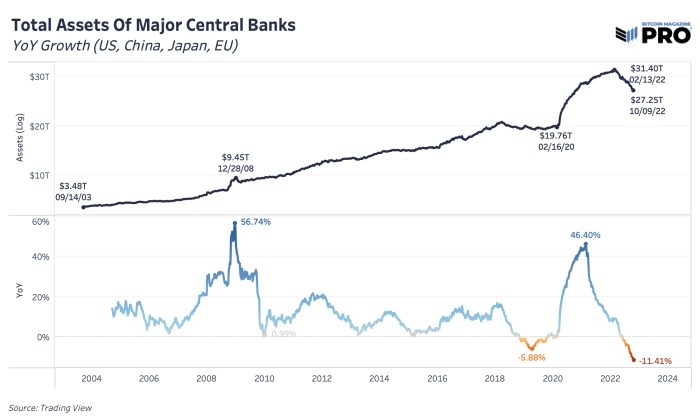

The state overreach I laid out above was allowed by the power of the cash printer. The impacts of which have actually now concerned haunt the international economy. The U.S. federal government, for instance, invested an overall of $5.2 trillion on COVID-19 relief by mid-2021 To put this in point of view, the U.S. federal government spent the equivalent of $4.7 trillion in today's dollars to money the most pricey war in history, World War II. Skyrocketing inflation, broken supply chains, ever-increasing rates of interest, increases in joblessness, looming sovereign financial obligation crises, the European energy crisis, sped up currency decline and a financial recession are simply a few of the effects caused by the financial reaction to the pandemic, with more to come. The worldwide economy remains in such a mess that the U.N. needed to plead with main lenders not to trek rate of interest! Not just do these occasions provide us higher insight into the damaging nature of the fiat system, however they are a precursor of things to come ought to this system stay undamaged without an option.

The world's reserve banks are presently taken part in a " worldwide arms race" to present reserve bank digital currencies (CBDCs), with a minimum of 105 nations actively checking out introducing a CBDC. CBDCs are the main organizers' method of attempting to preserve importance in the international economy due to the danger presented to fiat currencies by bitcoin and stablecoins. They do not fix the most significant defect of fiat currencies; the outright requirement of federal governments to engineer development through financial inflation. They are really fiat on steroids. The danger of CBDCs being combined with a Chinese-style social credit system continues to grow and they are an Orwellian type of cash since they provide no personal privacy, are simpler for The State to seize and they still get debased-- however at a much faster rate due to their programmable nature. CBDCs are monitoring innovation masquerading as cash, developed to broaden The State's control over our monetary lives.

According to a current paper by the Bitcoin Policy Institute entitled, "Why the U.S. Should Reject Central Bank Digital Currencies":

" Central banks handled unmatched levels of financial obligation throughout the COVID-19 pandemic-- a crisis that just sped up the basic pattern of increasing sovereign financial obligation that has actually been continuous given that the mid-20 th century. Worldwide debt-to-GDP ratio had actually increased to an amazing 356% by the end of 2021, with 30% of the boost happening given that2016 Since mid-2021, fast boosts in sovereign financial obligation had actually currently driven a number of nations into sovereign default and positioned lots of others on the edge. Even nations that are structurally more solvent since their financial obligation is denominated in their own currencies, like the United States, the United Kingdom, Japan, and China, are worried about the unfavorable financial impacts of swelling financial obligation ... In short, federal governments require cash, quick. As we will see, CBDCs represent a chance to extract it from personal money holdings"

Simply put CBDCs would make it possible for The State to perform monetary repression of the greatest type at the push of a button by indirectly taxing individuals's cost savings through the setting of unfavorable rate of interest on all CBDC balances. This technique is not brand-new and has actually likewise been formerly suggested by the IMF in a 2015 paper entitled "The Liquidation of Government Debt." Traditionally, this was done by producing synthetic need for federal government bonds in order to lower their yields; the lowered yields coupled with a high inflation rate would lead to unfavorable genuine rates of interest The paper plainly details this technique of monetary repression in terrific information and clearly suggests it as a good idea in spite of its damage to individuals's cost savings Whoever manages your cash, manages you, and it's clear that CBDCs are not simply helpful for monitoring-- they are tools for financial repression and social engineering.

As currencies damage and end up being more unsteady, the powers that be generally attempt to avoid their people from discarding the weaker regional currency for a more powerful one, which eventually causes individuals's cost savings being seriously decreased the value of. The distinction now is the more powerful currency is bitcoin; a reality that was just recently mentioned in a tweet by Microstrategy Chairman, Michael Saylor where he revealed the decline of every significant world currency versus the dollar in the in 2015, and the dollar's loss in worth versus bitcoin. In addition to the CBDC pilot tasks, we can currently see media projects cautioning about the ecological effect of bitcoin and the steady present of federal government guidelines that are crafted with the intent of discouraging bitcoin ownership and self-custody. Gradually however certainly they are attempting to obstruct the exits out of the fiat system.

Link to ingrained tweet.

As kept in mind in the opening paragraph, the fight for the future of cash is on and the main coordinators, the gerontocracy, along with their cantillionaire friends are going to toss whatever at bitcoin to attempt and stop it. With CBDCs quick approaching, and aggressive attacks being tossed out versus Bitcoin, how do we make sure that hyperbitcoinization comes true? While there is no single proper response to this concern, something's for sure: Merely sounding the alarm versus the risks of CBDCs and exposing the deceptive fiat system is terrific, however it's insufficient. Notifying individuals of what not to do, does not immediately lead to them doing what they should.

My favored option to releasing Bitcoin's complete capacity and cultivating mass adoption is the structure of a parallel economy (AKA a Bitcoin circular economy) that has a bitcoin requirement as its structure, with products and services being priced in bitcoin. Grass-roots bitcoin neighborhoods such as Bitcoin Beach in El Salvador, Bitcoin Ekasi in South Africa, Harlem Bitcoin in New York, Bitcoin Lisboa in Portugal, BTC Beach Camp in Thailand and Bitcoin Lake in Guatemala work as examples of bottom-up efforts that can cause hyperbitcoinization, as held true with Bitcoin Beach which turned into one of the drivers that resulted in the adoption of bitcoin as legal tender in El Salvador. These neighborhoods likewise work as the very best structures for developing a bitcoin-based parallel economy that will ultimately decouple from the U.S. dollar. At its core Bitcoin was developed to be a peer-to-peer financial system, where "one bitcoin=one bitcoin," not as a fiat-denominated speculative property.

In order to speed up bottom-up grassroots adoption, brand-new easy to use tools like wallets should be developed that will make it possible to onboard as many individuals as possible, especially in locations where monetary exemption is the standard. An example of such a tool is Machankura, which is a disorganized extra service information(USSD)- based custodial wallet that runs on-top of the Lightning Network and does not need a web connection. While being a custodial service has its drawbacks, the group at Machankura are presently checking out the concept of a non-custodial service that utilizes SIM cards as a finalizing gadget for finalizing and broadcasting deals to the remainder of the network. Need to they handle to pull it off, it would be a substantial advancement of huge percentages.

Despite USSD being old innovation,90% of all mobile deals in Africa today are powered by USSD. This is generally due to the supremacy of function phones, which make up 58.3% of Africa's cellular phone market. Offered these characteristics, Machankura's option of establishing a USSD-powered bitcoin wallet is a best fit. Currently, Machankura has a footprint in 9 African nations, specifically South Africa, Zambia, Namibia, Kenya, Tanzania, Uganda, Nigeria, Ghana and Malawi.

The primary objective behind the job is to drive monetary addition through the Bitcoin environment in locations with underdeveloped web facilities and/or low smart device penetration, as holds true in a great deal of African nations along with in the majority of the Global South. In spite of the low mobile phone penetration in Africa,70% of the $1 trillion worth of mobile cash deals worldwide were performed by users in Africa. While research study has actually revealed the favorable effect of mobile cash on establishing a cost savings culture in low earnings homes, the users of these services aren't protected from the results of financial inflation as their cost savings will still be denominated in a fiat currency that slowly declines. Furthemore, mobile cash services might possibly be obsoleted as soon as a CBDC is presented, or the company might be co-opted into being CBDC suppliers. As a bitcoin-focused service, Machankura is unsusceptible to all of the above.

According to the International Labour Organization's (ILO) price quotes, a minimum of 2 billion individuals worldwide are informally utilized. In Africa, where a minimum of 57% of grownups are unbanked, the casual sector represent over 85% of all work and contributes a minimum of 55% to the continent's $1.95 trillion GDP according to research studies carried out by the UN and the African Development Bank With most of these casual employees being unbanked, money ends up being the default choice for negotiating, hence making them simple targets for CBDCs, which will be marketed to them as a course to monetary addition. Even the Bank of International Settlements (BIS) recognized monetary addition as an essential chauffeur of CBDC adoption in emerging markets. As a low-tech option that is currently functional, Machankura is an important tool that works in not only banking the unbanked however in helping with open market and hence driving Bitcoin adoption prior to most of CBDCs have actually been officially presented. With the casual economy currently existing beyond The State's permissioned "official economy," embedding sound cash into it by means of Machankura is a no-brainer.

In the words of Heritage Falodun, a Nigerian-based software application engineer and Bitcoin expert:

"Bitcoin adoption in Africa will not be stimulated on by legislation alone, however by establishing less intricate payment rails that lower the barriers to entry into the Bitcoin community, and Machankura is a terrific example of this."

I could not concur more. Paco de la India, a Bitcoin teacher taking a trip the world exclusively on Bitcoin on a trip called " Run With Bitcoin," was considerably impressed by Machankura's ease of usage when he utilized the service in Nigeria. While the service is reasonably brand-new in Nigeria, de la India and a regional Nigerian Bitcoiner, Apata Johnson, were not just able to speak about the power of bitcoin however to show it by sending out sats to a few of the residents by means of Machankura. Bitcoin Ekasi in South Africa have actually likewise integrated Machankura into their orange pilling toolkit and are utilizing it for sending out sats on a weekly basis to their recipients.

Link to ingrained tweet.

During an interview I had with Kgothatso Ngako, the creator of Machankura, stablecoins turned up and I asked him if they had any intent of integrating stablecoin payments into Machankura, to which he reacted, "No we are simply focused just on bitcoin." An outstanding reaction, considered that much of bitcoin's critics fast to indicate bitcoin's cost volatility as one of the reasons it's inappropriate as a method of exchange. Stablecoins are then provided as the response to the circulating medium function. While stablecoins do provide "cost stability" in the short-term, making them a crucial intermediate action towards hyperbitcoinization, being tokenized fiat currencies they are not unsusceptible to debasement over the long term. In other words, inflation is the rate for fiat "stability" that a stablecoin uses. Bitcoin on the other hand is a deflationary currency with a steady financial policy that increases in worth with time. This is a point that Austrian financial expert, Hans-Hermann Hoppe, remarkably set out in " How Is Fiat Money Possible?" when he composed:

" Moreover, what is so excellent about 'steady' buying power anyhow (nevertheless that term may be arbitrarily specified)? To be sure, it is clearly more effective to have a 'steady' cash instead of an 'inflationary' one. Certainly a cash whose acquiring power per system increased-- 'deflationary' cash-- would be more effective to a 'steady' one."

Machankura's bitcoin focus seals its position as an important part of the worldwide hyperbitcoinization facilities for numerous countless individuals in Africa and all over the world who do not have access to trustworthy web, however still require sound cash. The fiat financial system was never ever developed to work for everyone as the establishing world has for years had actually inflation exported to it by the industrialized world. The fiat system's misaligned rewards make sure that the ineffective are rewarded at the cost of the efficient. The introduction of Bitcoin altered all of this by upgrading a much better type of cash from the ground up. Tools like Machankura are vital for driving adoption and making Bitcoin available to everybody, all over. Machankura is an extension of Satoshi Nakamoto's vision of a peer-to-peer financial system, one that lowers dependence on fiat intermediaries while powering Bitcoin circular economies.

This is a visitor post by Kudzai Kutukwa. Viewpoints revealed are completely their own and do not always show those of BTC Inc. or Bitcoin Magazine.

Read More

https://bitcofun.com/bitcoin-adoption-happens-fastest-in-circular-economies/?feed_id=47595&_unique_id=6360923e7e36b

This is a viewpoint editorial by Kudzai Kutukwa, an enthusiastic monetary addition supporter who was acknowledged by Fast Company publication as one of South Africa's top-20 young business owners under 30.

This is a viewpoint editorial by Kudzai Kutukwa, an enthusiastic monetary addition supporter who was acknowledged by Fast Company publication as one of South Africa's top-20 young business owners under 30.

This is a viewpoint editorial by Stephan Livera, host of the "Stephan Livera Podcast" and handling director of Swan Bitcoin International.

This is a viewpoint editorial by Stephan Livera, host of the "Stephan Livera Podcast" and handling director of Swan Bitcoin International. This is a viewpoint editorial by Julian Liniger, the co-founder and CEO of Relai, a bitcoin-only financial investment app.

This is a viewpoint editorial by Julian Liniger, the co-founder and CEO of Relai, a bitcoin-only financial investment app.