The listed below is an excerpt from a current edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be amongst the very first to get these insights and other on-chain bitcoin market analysis directly to your inbox, subscribe now

Liquidity Is In The Driver Seat

By far, among the most crucial consider any market is liquidity-- which can be specified in several methods. In this piece, we cover some methods to think of international liquidity and how it affects bitcoin.

One top-level view of liquidity is that of reserve banks' balance sheets. As reserve banks have actually ended up being the minimal purchaser of their own sovereign financial obligations, mortgage-backed securities and other monetary instruments, this has actually provided the marketplace with more liquidity to purchase properties even more up the threat curve. A seller of federal government bonds is a purchaser of a various property. When the system has more reserves, cash, capital, and so on (nevertheless one wishes to explain it), they need to go someplace.

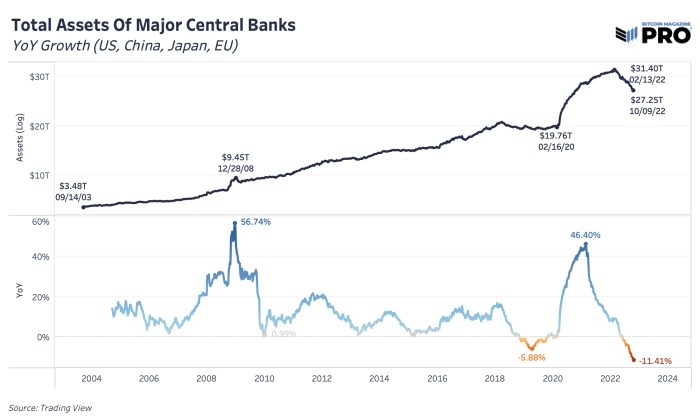

In lots of manner ins which has actually caused among the biggest increases in property appraisals internationally over the last 12 years, accompanying the brand-new age of quantitative easing and financial obligation money making experiments. Reserve bank balance sheets throughout the United States, China, Japan and the European Union reached over $31 trillion previously this year, which is almost 10 X from the levels back in2003 This was currently a growing pattern for years, however the 2020 financial and financial policies took balance sheets to record levels in a time of international crisis.

Since previously this year, we've seen a peak in reserve bank properties and a worldwide effort to unwind these balance sheets. The peak in the S&P 500 index was simply 2 months prior to all of the quantitative tightening up (QT) efforts we're enjoying play out today. Not the only aspect that drives cost and appraisals in the market, bitcoin's cost and cycle has actually been impacted in the very same method. The yearly rate-of-change peak in significant reserve banks' properties took place simply weeks prior to bitcoin's very first push to brand-new all-time highs around $60,000, back in March2021 Whether it's the direct effect and impact of reserve banks or the marketplace's understanding of that effect, it's been a clear macro driving force of all markets over the last 18 months.

There is an international effort to unwind reserve bank balance sheets

At a market cap of simply portions of international wealth, bitcoin has actually dealt with the liquidity steamroller that's hammered every other market worldwide. If we utilize the structure that bitcoin is a liquidity sponge (more so than other properties)-- taking in all of the excess financial supply and liquidity in the system in times of crisis growth-- then the substantial contraction of liquidity will cut the other method. Combined with bitcoin's inelastic illiquid supply profile of 77.15% with a large variety of HODLers of last hope, the unfavorable effect on cost is amplified a lot more than other properties.

One of the prospective motorists of liquidity in the market is the quantity of cash in the system, determined as international M2 in USD terms. M2 cash supply consists of money, examining deposits, cost savings deposits and other liquid kinds of currency. Both cyclical growths in worldwide M2 supply have actually taken place throughout the growths of international reserve bank properties and growths of bitcoin cycles.

We see bitcoin as a financial inflation hedge (or liquidity hedge) instead of one versus a "CPI" (or cost) inflation hedge. Monetary debasement, more systems in the system in time, has actually driven lots of possession classes greater. Bitcoin is by far the best-designed property in our view and one of the best-performing possessions to neutralize the future pattern of continuous financial debasement, cash supply growth and main bank property growth.

It's uncertain for how long a material decrease in the Fed's balance sheet can really last. We've just seen an approximate 2% decrease from a $ 8.96 trillion balance sheet issue at its peak. Ultimately, we see the balance sheet broadening as the only choice to keep the whole financial system afloat, however up until now, the marketplace has actually undervalued how far the Fed has actually wanted to go.

The absence of feasible financial policy alternatives and the inevitability of this continuous balance sheet growth is among the greatest cases for bitcoin's long-run success. What else can reserve banks and financial policy makers carry out in future times of economic downturn and crisis?

Relevant Past Articles:

- 10/ 7/22 - Not Your Average Recession: Unwinding The Largest Financial Bubble In History

- 8/2/22 - July Month Report: Long Live Macro

- 2/18/22 - Higher Volatility And Less Liquidity

Read More https://bitcofun.com/bitcoin-faces-the-liquidity-steamroller-of-global-markets/?feed_id=47607&_unique_id=6360ae7338300

No comments:

Post a Comment