This is a viewpoint editorial by Luke Mikic, an author, podcast host and macro expert.

This is a viewpoint editorial by Luke Mikic, an author, podcast host and macro expert.This is the 2nd part in a two-part series about the Dollar Milkshake Theory and the natural development of this to the "Bitcoin Milkshake." In this piece, we'll check out where bitcoin suits an international sovereign financial obligation crisis.

The Bitcoin Milkshake Theory

Most individuals think the money making of bitcoin will most harm the United States as it's the nation with the present worldwide reserve currency. I disagree.

The money making of bitcoin advantages one country disproportionally more than any other nation. Like it, invite it or prohibit it, the U.S. is the nation that will benefit most from the money making of bitcoin. Bitcoin will assist to extend the life of the USD longer than lots of can conceive and this short article describes why.

If we progress on the presumption that the Dollar Milkshake Thesis continues to annihilate weaker currencies around the globe, these nations will have a choice to make when their currency goes through run-away inflation. A few of these nations will be required to dollarize, like the more than 65 nations that are either dollarized or have their regional currency pegged to the U.S. dollar.

Some might pick to embrace a quasi-gold requirement like Russia just recently has. Some might even pick to embrace the Chinese yuan or the euro as their regional legal tender and system of account. Some areas might copy what the shadow federal government of Myanmar have actually done and embrace the Tether stablecoin as legal tender. Most notably, some of these nations will embrace bitcoin.

For the nations that might embrace bitcoin, it will be too unstable to make financial computations and utilize as a system of account when it's still so early in its adoption curve.

Despite what the agreement story is surrounding those who state, "Bitcoin's volatility is reducing since the organizations have actually shown up," I highly think this is not a settled in truth. In a previous post composed in late 2021 examining bitcoin's adoption curve, I laid out why I think the volatility of bitcoin will continue to increase from here as it takes a trip through $500,000, $1 million and even $5 million per coin. I believe bitcoin will still be too unpredictable to utilize as a real system of account till it breaches 8 figures in today's dollars-- or as soon as it soaks up 30% of the world's wealth.

For this factor, I think the nations who will embrace bitcoin, will likewise be required to embrace the U.S. dollar particularly as a system of account. Countries embracing a bitcoin requirement will be a Trojan horse for ongoing worldwide dollar supremacy.

Put aside your viewpoints on whether stablecoins are shitcoins for simply a 2nd. With current advancements, such as Taro bringing stablecoins to the Lightning Network, envision the possibility of moving stablecoins around the globe, quickly and for almost no charges.

The Federal Reserve of Cleveland appears to be paying very close attention to these advancements, as they just recently released a paper entitled, " The Lightning Network: Turning Bitcoin Into Money"

Zooming out, we can see that given that March 2020, the stablecoin supply has actually grown from under $5 billion to over $150 billion.

What I discover most intriguing is not the rate of development of stablecoins, however which stablecoins are growing the fastest. After the current Terra/LUNA fiasco, capital left from what's viewed to be more "dangerous" stablecoins like tether, to more "safe" ones like USDC.

This is due to the fact that USDC is 100% backed by money and short-term financial obligation

BlackRock is the world's biggest property supervisor and just recently headlined a $440 million fundraising round by purchasing Circle. It wasn't simply a financing round; BlackRock is going to be acting as the main property supervisor for USDC and their treasury reserves, which is now almost $50 billion.

The previously mentioned Tether seems following in the steps of USDC. Tether has actually long been slammed for its opaqueness and the reality it's backed by dangerous industrial paper. Tether has actually been deemed the uncontrolled overseas U.S. dollar stablecoin. That being stated, Tether offered their riskier business paper for more beautiful U.S. federal government financial obligation. They likewise accepted go through a complete audit to enhance openness.

If Tether is real to their word and continues to back USDT with U.S. federal government financial obligation, we might see a situation in the future where 80% of the overall stablecoin market is backed by U.S. federal government financial obligation. Another stablecoin provider, MakerDao, likewise capitulated today, purchasing $500 million federal government bonds for its treasury.

It was vital that the U.S. dollar was the primary denomination for bitcoin throughout the very first 13 years of its life throughout which 85% of the bitcoin supply had actually been launched. Network results are tough to alter, and the U.S. dollar stands to benefit most from the expansion of the total "crypto" market.

This Bretton Woods III structure properly explains the problem dealing with the United States: The nation requires to discover somebody to purchase their financial obligation. Numerous dollar doomsayers presume the Fed will need to generate income from a great deal of the financial obligation. Others state that increased policies are on the method for the U.S. business banking system, which was managed to hold more Treasurys in the 2013-2014 period, as nations like Russia and China started divesting and slowing their purchases. What if a multiplying stablecoin market, backed by federal government financial obligation, can assist soak up that lost need for U.S. Treasurys? Is this how the U.S. discovers an option to the relaxing petrodollar system?

Interestingly, the U.S. requires to discover a service to its financial obligation issues, and quickly. Countries worldwide are racing to leave the dollar-centric petrodollar system that the U.S. for years has actually had the ability to weaponize to entrench its hegemony. The BRICS countries have actually revealed their objectives to produce a brand-new reserve currency and there are a host of other nations, such as Saudi Arabia, Iran, Turkey and Argentina that are using to end up being a part of this BRICS collaboration To make matters worse, the United States has $9 trillion of financial obligation that grows in the next 24 months.

Who is now going to purchase all that financial obligation?

The U.S. is as soon as again backed into a corner like it remained in the 1970 s. How does the nation secure its almost 100- year hegemony as the worldwide reserve currency company, and 250- year hegemony as the world's dominant empire?

Currency Wars And Economic Wild Cards

This is where the thesis ends up being a lot more speculative. Why is the Fed continuing to strongly raise rates of interest, bankrupting its expected allies like Europe and Japan, while relatively sending out the world into a worldwide anxiety? "To battle inflation," is what we're informed.

Let's check out an option, possible reason the Fed might be raising rates so strongly. What alternatives does the U.S. need to protect its hegemony?

In a world presently under a hot war, would it appear so improbable to hypothesize that we could be getting in a financial cold war? A war of reserve banks, if you will? Have we forgotten the "weapons of mass damage?" Have we forgotten what we did to Libya and Iraq for trying to path around the petrodollar system and stop utilizing the U.S. dollar in the early 2000 s?

Until 6 months earlier, my base case was that the Fed and reserve banks around the world would act in unison, pinning rates of interest low and utilize the " monetary repression sandwich" to pump up away the world's huge and unsustainable 400% debt-to-GDP ratio. I anticipated them to follow the financial plans set out by 2 financial white documents. The very first one released by the IMF in 2011 entitled, " The Liquidation Of Government Debt" and after that the 2nd paper released by BlackRock in 2019 entitled, " Dealing With The Next Downturn"

I likewise anticipated all the reserve banks to operate in tandem to approach executing reserve bank digital currencies (CBDCs) and collaborating to carry out the "Great Reset." When the information modifications, I alter my viewpoints. Because the creepingly collaborated policies from federal governments and reserve banks worldwide in early 2020, I believe some nations are not so lined up as they when were.

Until late 2021, I held a strong view that it was mathematically difficult for the U.S. to raise rates-- like Paul Volcker performed in the 1970 s-- at this phase of the long-lasting financial obligation cycle without crashing the worldwide financial obligation market.

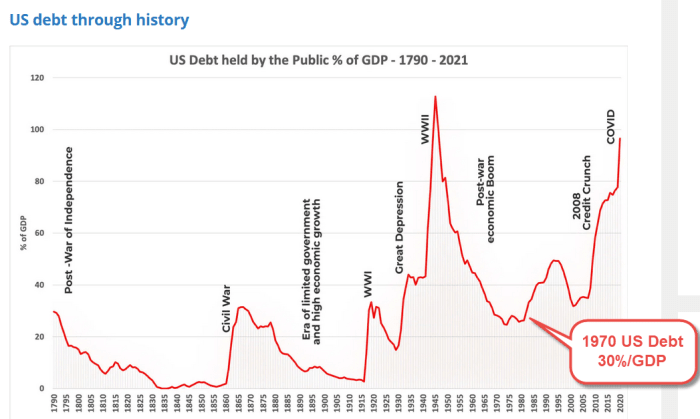

Debt held by the public is almost as high as times throughout WWII

But, what if the Fed wishes to crash the worldwide financial obligation markets? What if the U.S. acknowledges that a strengthening dollar triggers more discomfort for its worldwide rivals than on their own? What if the U.S. acknowledges that they would be the last domino left standing in a waterfall of sovereign defaults? Would collapsing the international financial obligation markets cause hyperdollarization? Is this the only financial wild card the U.S. has up its sleeve to lengthen its reign as the dominant international hegemon?

While everybody is awaiting the Fed pivot, I believe the most essential pivot has actually currently taken place: the Dalio pivot.

As a Ray Dalio disciple, I've constructed my whole macroeconomic structure on the concept that "money is garbage." I think that mantra still applies for anybody utilizing any other fiat currency, however has Dalio came across some brand-new details about the USD that has altered his mind?

Dalio composed an incredible book " The Changing World Order: Why Nations Succeed or Fail" that information how wars happen when international empires clash.

Has he concluded that the United States could be ready to weaponize the dollar, making it not so trashy? Has he concluded that the U.S. isn't going to voluntarily enable China to be the world's next increasing empire like he when announced? Would the U.S. strongly raising rates result in a capital flight to the U.S., a nation that has a relatively much healthier banking system than its rivals in China, Japan and Europe? Do we have any proof for this extravagant left-field, theoretical situation?

Let's likewise not forget, this is not simply a race with the United States versus China. The second-most utilized foreign currency on the planet-- the euro-- most likely would not mind getting power from a decreasing U.S. empire. We need to ask the concern, why is Jerome Powell declining to line up financial policies with among our closest allies in Europe?

In this illuminating 2021 webinar, at the Green Swan main banking conference, Powell blatantly declined to support the "green main banking" policies that were talked about. This noticeably irritated Christine Lagarde, head of the European Central Bank, who was like wise part of the occasion.

Some of the quotes from Powell because interview are illuminating.

Is this an indication the U.S. is no longer a fan of the Great Reset ideologies coming out of Europe? Why is the Fed likewise neglecting the United Nations pleading them to lower rates?

We can hypothesize about what Powell's intents might be all the time, however I choose to take a look at information. Given that Powell's preliminary heated argument with Lagarde and the Fed's subsequent rate boost on the reverse repo days after, the dollar has actually annihilated the euro.

Reverse repo rates at first increased on May 31, 2022

In April 2022, Powell was dragged into another " argument" with Lagarde, led by the head of the IMF. Powell declared his position on environment modification and main banking.

The plot thickens when we think about the ramifications of the LIBOR and SOFR rate of interest shift that happened at the start of2022 Will this rates of interest modification allow the Fed to trek rates of interest and insulate the banking system from the contagion that'll take place from a wave of worldwide financial obligation defaults in the broader eurodollar market?

I do believe it's fascinating that by some metrics the U.S. banking system is revealing relatively less indications of tension than in Europe or the remainder of the world, verifying the thesis that SOFR is insulating the U.S. to a degree.

A New Reserve Asset

Whether the U.S. is at war with other reserve banks or not does not alter the reality that the nation requires a brand-new neutral reserve property to back the dollar. Producing an international deflationary bust, and weaponizing the dollar is just a short-term play Scooping up properties on the inexpensive and weaponizing the dollar will just require dollarization in the short-term. The BRICS countries and others that are disappointed with the SWIFT-centered monetary system will continue to de-dollarize and attempt to develop an option to the dollar.

The international reserve currency has actually been informally backed by the U.S. Treasury note for the past 50 years, because Nixon closed the gold window in1971 In times of threat, individuals go to the reserve possession as a method to obtain dollars. For the past 50 years, when equities sell, financiers left to the "security" of bonds which would value in "run the risk of off" environments. This vibrant developed the structure of the notorious 60/40 portfolio-- till this trade eventually broke in March 2020 when the Treasury market ended up being illiquid.

As we shift into the Bretton Woods III period, the Triffin predicament is lastly ending up being illogical. The U.S. requires to discover something to back the dollar with. I discover it not likely that they will back the dollar with gold. This would be playing into the hands of Russia and China who have far bigger gold reserves.

This leaves the U.S. with their backs versus a wall. Faith is being lost in the dollar and they would undoubtedly wish to maintain their worldwide reserve currency status. The last time the U.S. remained in a likewise susceptible position remained in the 1970 s with high inflation. It appeared like the dollar would stop working till the U.S. efficiently pegged the dollar to oil through the petrodollar contract with the Saudis in 1973.

The nation is confronted with a comparable dilemma today however with a various set of variables. They no longer have the choice of backing the dollar with oil or gold.

Enter Bitcoin!

Bitcoin can support the dollar and even extend its worldwide reserve currency status for a lot longer than lots of people anticipate! Most notably, bitcoin provides the U.S. the something it requires for the 21 st-century financial wars: trust.

Countries might rely on a gold-backed (petro-) ruble/yuan more than a dollar backed by useless paper. A bitcoin-backed dollar is far more reliable than a gold-backed (petro-) ruble/yuan.

As discussed previously, the money making of bitcoin not just assists the U.S. financially, however it likewise straight injures our financial rivals, China and to a lower degree, Europe-- our expected ally.

Will the U.S. understand that backing the dollar with energy straight harms China and Europe? China and Europe are both dealing with substantial energy-related headwinds and have actually both infamously prohibited Bitcoin's proof-of-work mining. I made the case that the energy crisis in China was the genuine factor China prohibited bitcoin mining in2021

Today, as we shift into the digital age, I think a basic shift is coming:

For countless years, cash has actually been backed by trust and gold, and safeguarded by ships. In this millennium, cash will now be backed by file encryption and mathematics, and secured by chips.

If you will permit me to as soon as again take part in some speculation, I think the U.S. comprehends this truth, and is getting ready for a deglobalized world in various methods. The U.S. seems the Western country taking the friendliest method to Bitcoin. We have senators all throughout the U.S. tripping over themselves to make their states Bitcoin centers by enacting friendly guideline for mining. The excellent hash migration of 2021 has actually seen the lion's share of the Chinese hash being moved to the U.S., which now houses over 35% of the world's hash rate.

Recent sanctions on Russian miners might just even more accelerate this hash migration. Apart from some sound in New York, and the postponed area ETF choice, the U.S. looks as though it's accepting bitcoin.

In this video, Treasury Secretary Janet Yellen speaks about Satoshi Nakamoto's development. The SEC Chair Gary Gensler constantly separates Bitcoin from "crypto" and has actually likewise applauded Satoshi Nakamoto's creation.

ExxonMobil is the biggest oil business in the U.S. and revealed it was utilizing bitcoin mining to offset its carbon emissions.

Then there's the concern, why has Michael Saylor been enabled to wage a speculative attack on the dollar to purchase bitcoin? Why is the Fed launching tools highlighting how to price eggs(and other items) in bitcoin terms? If the U.S. was so opposed to prohibiting bitcoin, why has all of this been allowed the nation?

We're transitioning from an oil-backed dollar to a bitcoin-backed dollar reserve property. Crypto-eurodollars, aka stablecoins backed by U.S. financial obligation, will offer the bridge in between the existing energy-backed dollar system and this brand-new energy-backed bitcoin/dollar system. I discover it very poetic that the nation based on the ideology of flexibility and self-sovereignty seems placing itself to be the one that the majority of makes the most of this technological development. The bitcoin-backed dollar is the only option to an increasing Chinese risk placing for the international reserve currency.

Yes, the United States has actually devoted lots of atrocities, I 'd argue that sometimes they've been guilty of abusing their power as the worldwide hegemon. In a world that's being quickly taken in by ramped totalitarianism, what takes place if the magnificent U.S. experiment stops working? What occurs to our civilization if we permit a social-credit-scoring Chinese empire to increase and export its CBDC-backed digital panopticon to the world? I was as soon as among these individuals cheering for the death of the U.S. empire, however I now fear the survival of our extremely civilization depends on the survival of the nation that was initially based on the concepts of life, liberty and home.

Conclusions

Zooming out, I wait my initial thesis that we remain in a brand-new financial order by the end of the years. The occasions of the previous months have actually definitely sped up that already-rapid 2030 timeline. I likewise wait my initial thesis from the 2021 short article surrounding how bitcoin's adoption curve unfolds due to the fact that of how damaged the present financial routine is.

I think 2020 was the financial inflection point that will be the driver that takes bitcoin from 3.9% worldwide adoption to 90% adoption this years. This is what crossing the gorge involves for all transformative innovations that reach mainstream penetration.

There will nevertheless be numerous "confident minutes" along the method, like there remained in the German Weimar hyperinflationary occasion of the 1920 s.

There will be dips and spikes in inflation, like there remained in the 1940 s throughout U.S. federal government deleveraging.

Deglobalization will be the best scapegoat for what was constantly going to be a years of federal government financial obligation deleveraging. The financial contractions and convulsions are ending up being more regular and more violent with each drawdown we experience. I think most of fiat currencies remain in the 1917 phases of the Weimar devaluation.

This short article was really fixated nation-state adoption of bitcoin, however do not forget what's genuinely unfolding here. Bitcoin is a Trojan horse for liberty and self-sovereignty in the digital age. Surprisingly, I likewise feel that hyperdollarization will accelerate this tranquil transformation.

Hyperinflation is the occasion that triggers individuals to do the work and learn more about cash. As soon as a lot of these power-hungry totalitarians are required to dollarize and no longer have the control of their regional cash printer, they might be more incentivized to take a bet on something like bitcoin. Some might even do it out of spite, not wishing to have their financial policy determined to them by the U.S.

Money is the main tool utilized by states to exercise their autocratic, authoritarian powers. Bitcoin is the technological development that'll liquify the nation-state, and fracture the power the state has, by eliminating its monopoly on the cash supply. In the very same method the printing press fractured the power of the vibrant duo that was the church and state, bitcoin will separate cash from state for the very first time in 5,000+ years of financial history.

So, to address the dollar doomsdayers, "Is the dollar going to pass away?" Yes! What will we see in the interim? De-dollarization? Perhaps on the margins, however I think we will see hyperdollarization followed by hyperbitcoinization.

This is a visitor post by Luke Mikic. Viewpoints revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Read More https://bitcofun.com/the-u-s-will-weaponize-the-dollar-by-backing-it-with-bitcoin/?feed_id=47651&_unique_id=636103bd297e4

No comments:

Post a Comment