Bitcoin mining business continue having a hard time to make it through the continuous bearish market. Imagine exceeding bitcoin as a public mining business are long gone. Insolvencies and suits make regular headings. And even Wall Street experts that were as soon as bullish on bitcoin mining financial investment chances now state they're"endingup until the marketplace enhances. Precisely how bad is the existing bear market?

It's constantly darkest prior to dawn, as the expression states. And compared to previous bearish market, the mining market looks much closer to the end of a rough market stage than the start of it. This post checks out a lot of information sets from the existing and previous bearishness to contextualize the state of the market and how the mining sector is faring. From hardware lifecycles and miner balances, to hash rate development and hash cost decreases, all of these information inform a special story about among Bitcoin's essential financial sectors.

Mining Revenue Is Evaporating

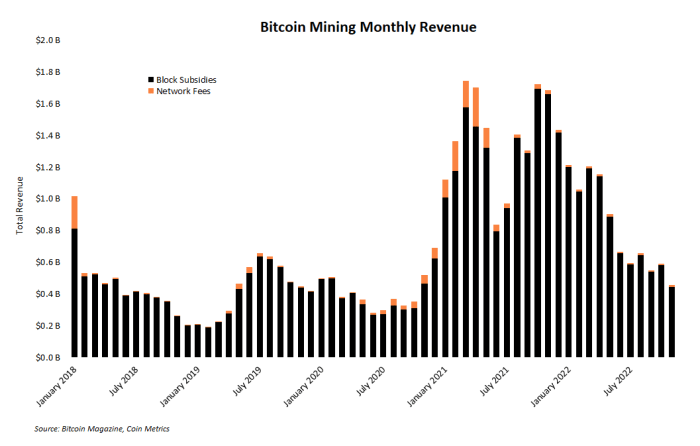

When bitcoin's rate drops, it's not unexpected that dollar-denominated mining income likewise drops. It has-- a lot. Approximately 900 BTC are still mined every day and will be up until the next halving in 2024. The fiat rate for those bitcoin has actually dropped this year, implying miners have far less dollars for costs like electrical power, upkeep and the maintenance of loans.

As the chart listed below shows, in November, the whole bitcoin mining market made less than $500 million from processing deals and releasing brand-new coins. The bar chart listed below programs this month-to-month earnings compared to the previous 5 years. November mining profits marks a two-year low for month-to-month profits.

Possible Hash Rate Uptrend Reversal

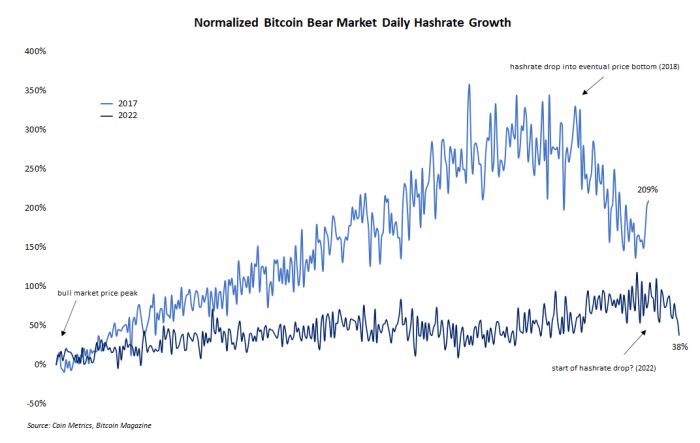

Comparing the existing bearishness to the previous one in 2018 uses some intriguing insights into how the mining market has actually altered and how it has actually stayed the exact same. One such contrast is hash rate development throughout down rate patterns. It's not unusual to see hash rate grow throughout bearish market. The annotated line chart listed below programs stabilized hash rate development throughout the 2018 and 2022 bearish market from bitcoin's cost peak to the drawdowns' history (or present) lows.

One thing that is clearly missing out on from the above chart is a correction in hash rate development throughout the later duration of the bearish stage. In 2018, for instance, the development pattern plainly altered course and dropped as the marketplace ultimately discovered a low for bitcoin's rate. In the existing market, hash rate has actually just grown. Possibly a small drop in hash rate through late November signals a pattern modification, however the concern is still open.

Collapse Of Public Mining Companies

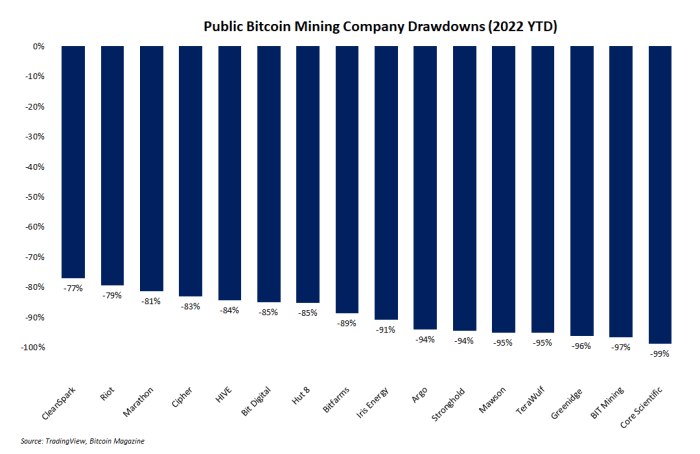

Maybe the most ruthless bitcoin mining chart of all reveals the drawdowns of publicly-traded mining business this year. It's clear that the previous year has actually been harsh for bitcoin, other cryptocurrencies, and the worldwide economy in basic. Mining business in specific have actually been clobbered. Over half of these business have actually seen their share rates tip over 90% because January. Just 2-- CleanSpark and Riot Blockchain-- have actually not dropped more than 80%.

Mining business in basic are frequently thought about to be a high-beta financial investment in bitcoin, indicating when bitcoin increases, mining stock costs increase more. This market vibrant cuts both methods, and when bitcoin falls, the disadvantage for mining stocks is even more harsh. The bar chart listed below programs the massacre these stocks have actually sustained.

The Rise And Fall Of Bitcoin Mining's 'AK-47'

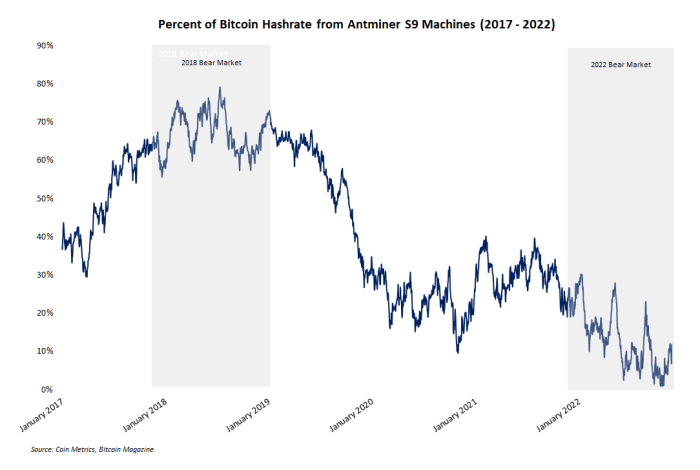

An underappreciated trademark of the present bitcoin bearishness is the sheer decrease in hash rate contributed by Bitmain's Antminer S9 devices. This design of mining device is sometimes referred to as the "AK-47" of mining since of its resilience and reputable efficiency. And at one point in the 2018 bearish market, the S9 was king. Almost 80% of Bitcoin's overall hash rate originated from this Bitmain design throughout the depths of the previous bearish market.

The existing bear market informs an entirely various story. Thanks to brand-new, more effective hardware and a vice-grip capture on mining earnings margins, the portion of hash rate from S9s dropped listed below 2% in early November. The annotated line chart listed below programs the fluctuate of this device.

Miner Balance Retraces Its Sell Off

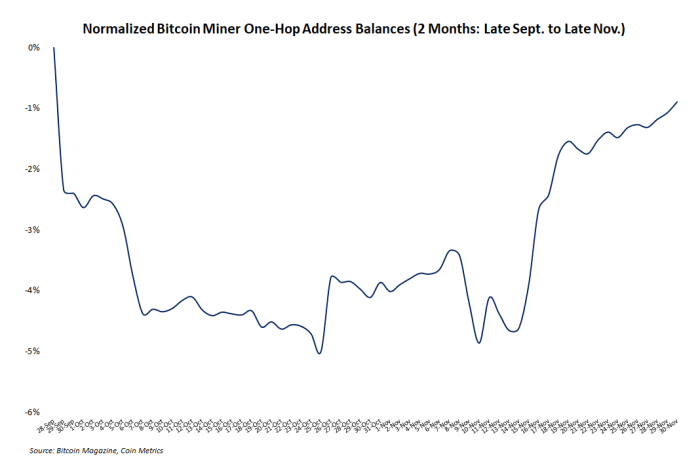

The previous couple of months have actually been devastating for the "crypto" market as exchange wars, insolvent custodians and other types of monetary contagion swept the marketplaceLots of bitcoin financiers like to presume their section of the market is mainly insulated from the turmoil of the rest of "crypto," however this is typically incorrect. When it comes to miners, who are infamously bad sometimes the marketplace, some panic appeared as address balances and miner outflows appeared to drop and increase, respectively.

This activity was brief lived. The line chart listed below programs that miner address balances have practically totally backtracked their drop from late September through October. Simply put, miners seem back in HODL mode, invulnerable to exogenous market occasions. Whether the bearishness is over or not is unidentified. Miners appear to be collecting more than selling.

Hash Price Drop Today Vs. 2018

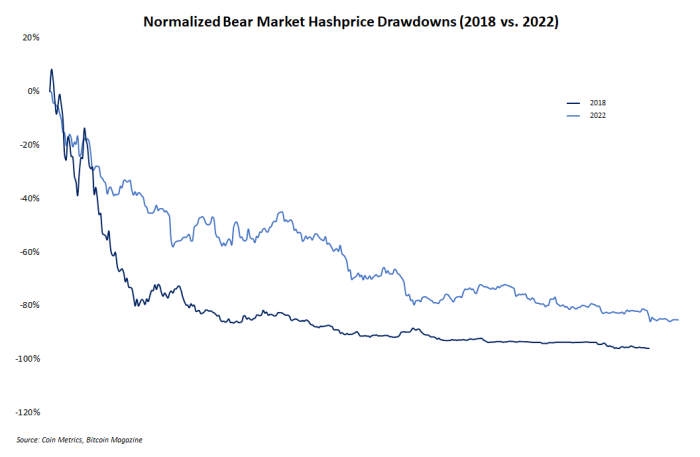

Hash rate is among the most popular financial metrics for miners to track, although couple of individuals beyond the mining sector comprehend it. Simply put, this metric represents the dollar-denominated earnings anticipated to be made per minimal system of hash rate. And like whatever else in the bearish market, hash rate has actually fallen considerably. Its decrease is not uncommon, specifically when it's compared to the hash cost decrease in 2018.

Displayed in the chart below are stabilized hash cost drawdowns from 2018 and 2022. Readers will discover the relatively comparable slope and size of the drawdowns. 2018 was somewhat steeper. 2022 to date has actually been shallower however longer. Both were and are ruthless for recently established mining operations.

The Next Phase Of Mining

Boom and bust cycles are a natural series of occasions for any appropriately operating market. The bitcoin mining sector is no exception. For the previous year, mining has actually seen its weaker, unprepared operators extracted as the excesses from the booming market are given account. Now, in the depths of a bearish duration, the genuine contractors can continue to broaden their operations and construct a strong structure for the next stage of blissful bullishness.

This is a visitor post by Zack Voell. Viewpoints revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Learn more https://bitcofun.com/these-six-charts-show-how-bitcoin-mining-is-enduring-the-bear-market/?feed_id=56968&_unique_id=63971de7a99a4

No comments:

Post a Comment