A brand-new report from on-chain analytics firm Glassnode has explained present market conditions as a "bear of historical percentages", including that "it can fairly be argued that 2022 is the most substantial bearish market in digital possession history":

JUST IN: 2022 bearishness is the worst in #Bitcoin history-- Glassnode

-- Bitcoin Archive (@BTC_Archive) June 27, 2022

This Year BTC's Worst on Record?

Following Glassnode's current report arguing we remained in " the darkest stage of the bearishness", its most current release, entitled "A Bear of Historic Proportions", lays out factors for thinking that 2022 has actually been the worst on record for Bitcoin.

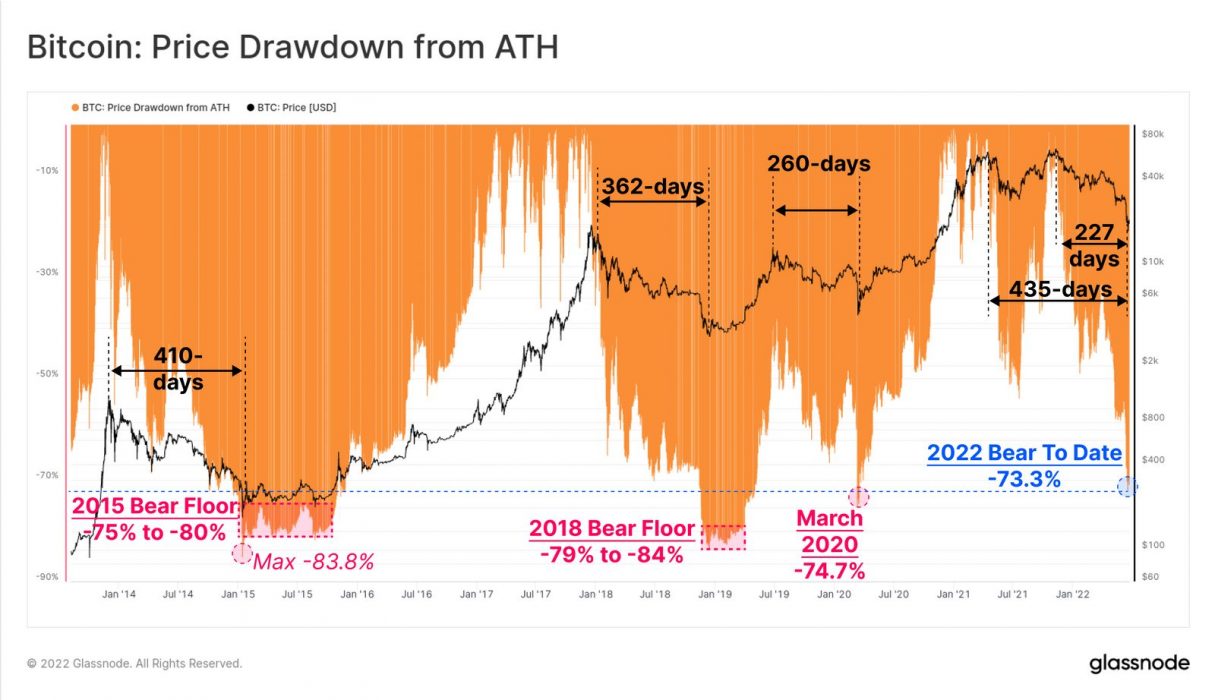

Interestingly, according to the blockchain analysis company, the bearish market began in April 2021 and not November 2021, given that "a big percentage of the minimal purchasers and sellers were flushed from the marketplace". It includes that bearishness lows generally have drawdowns in between -75 percent and -84 percent from the all-time high (ATH), taking in between 260 and 410 days.

With the present drawdown reaching -733 percent listed below the November 2021 ATH, Glassnode concludes that "this bearishness is now strongly within historic standards and magnitude":

Mayer Multiple in Rare Territory

One of the clearest indications of a bearishness is when the area cost of bitcoin drops listed below the 200- day moving average (MA) and, in hardly ever seen cases, listed below the 200- week MA.

To highlight, Glassnode utilizes the Mayer Multiple (MM), a metric utilized to recognize bear and booming market. Basically, when costs are listed below the 200- day MA it represents a bearish market, and when above the 200- day MA, a booming market. Presently, bitcoin's rate of around US$20,000 is at a really unusual level, considered that it is listed below half the 200- day MA:

Glassnode remarks that falling listed below 0.5 MM is an extremely uncommon occasion which hasn't occurred considering that 2015:

Only 84 out of 4160 trading days (2 percent) have actually taped a closing MM worth listed below 0.5. For the very first time in history, the 2021-22 cycle has actually taped a lower MM worth (0.487) than the previous cycle's low (0.511).

Glassnode report

Realised Price, Another Bear Signal

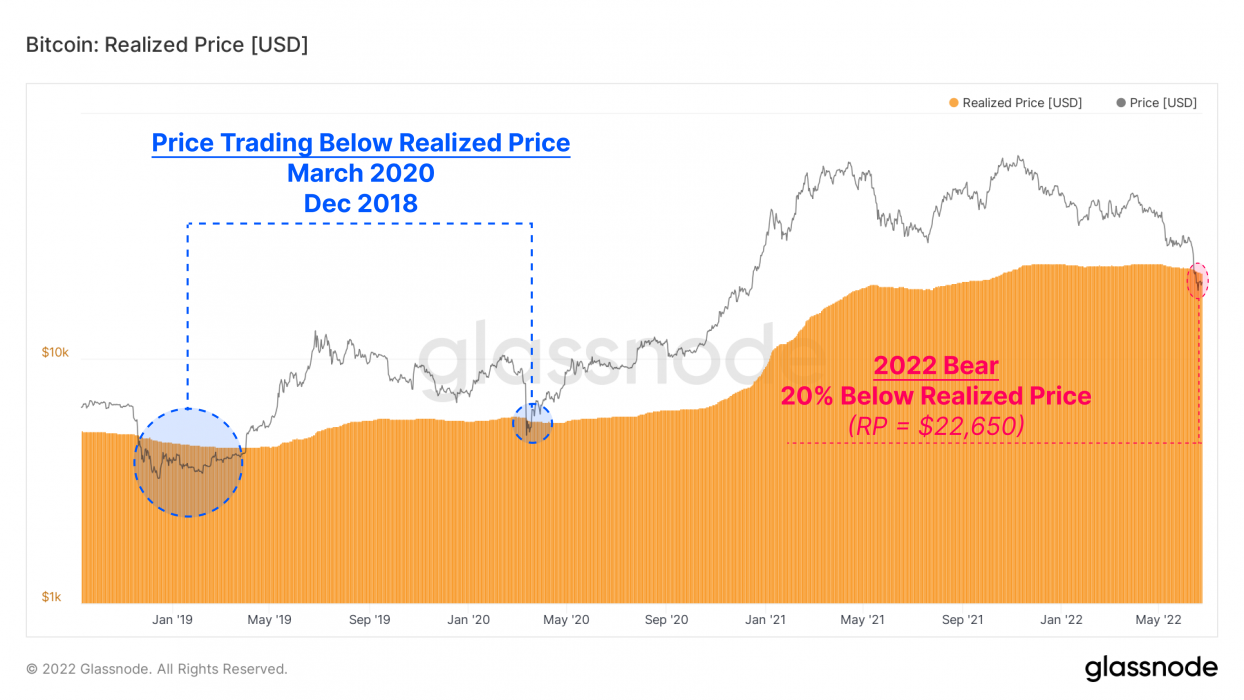

In addition to the MM, Glassnode likewise keeps in mind that Bitcoin's area rate is trading listed below "Realised Price", an appraisal metric determined by taking the worth of all bitcoins and the cost they were purchased, divided by the variety of bitcoins in flow.

Glassnode keeps in mind that the existing discount rate to Realised Price recommends that sellers are unloading their coins at a loss. This too is an unusual phenomenon, as area rate has actually just traded listed below Realised Price 5 times because Bitcoin's launch:

Spot rates are presently trading at an 11.3 percent discount rate to the understood cost, symbolizing that the typical market individual is now undersea on their position.

Glassnode report

To highlight the seriousness of present market conditions, Glassnode concludes by stating that the "variance from the MA is so big that just 2 percent of trading days have actually been even worse off". A bear market of historical percentages. Once again, it's all a matter of context:

Disclaimer: The material and views revealed in the posts are those of the initial authors own and are not always the views of Crypto News. We do actively inspect all our material for precision to assist safeguard our readers. This post material and links to external third-parties is consisted of for info and home entertainment functions. It is not monetary guidance. Please do your own research study prior to taking part.

Read More https://bitcofun.com/2022-has-been-a-bear-market-of-historic-proportions-glassnode-report/?feed_id=26519&_unique_id=62bf6fa7f00d9

No comments:

Post a Comment