The leading cryptocurrency deals with increased offering pressure as miners unload their coins to remain solvent.

Key Takeaways

- Multiple reports show that Bitcoin miners are selling more coins to cover the expense of their operations.

- Miners have actually offered an approximated $500 million worth of Bitcoin up until now in June, diminishing their stockpiles by nearly a 3rd.

- The required selling might suppress any significant healing for the leading crypto property.

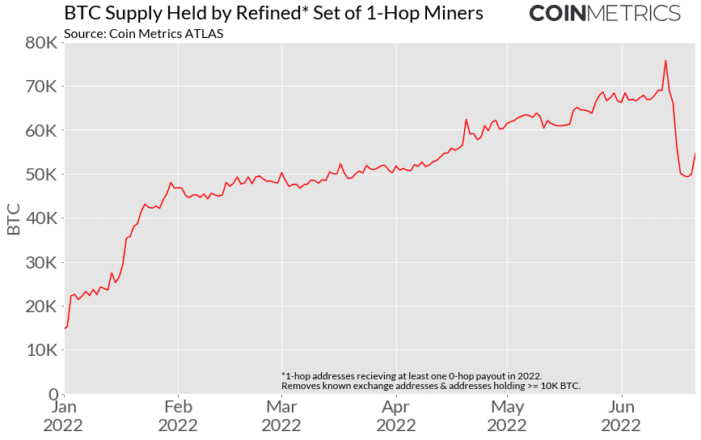

According to a current report from Coin Metrics, miners have actually cost least $500 million worth of Bitcoin up until now in June.

Bitcoin Miners Sell Reserves

The once-booming Bitcoin mining market has actually become its own worst opponent.

Multiple reports show that Bitcoin miners are selling more coins to cover the expense of their operations. The increased selling is weighing on any possible Bitcoin healing, resulting in more selling as miner success continues to sink listed below the expense of production.

A current report from Arcane research study has actually exposed a considerable uptick in the quantity of Bitcoin leaving miners' wallets. "In the very first 4 months of 2022, public mining business offered 30% of their bitcoin production. The plunging success of mining required these miners to increase their selling rate to more than 100% of their output in May," the report checked out, suggesting that functional expenses went beyond miners' revenues, requiring them to dip into their Bitcoin cost savings to comprise the distinction.

Elsewhere, leading Bitcoin miner Bitfarms ended up being the current in a long list of companies to increase its selling in the middle of the record-breaking crypto downswing. Bitfarms reported offering 3,00 0 Bitcoin for $62 million over the previous week in a quote to enhance its liquidity.

A current Coin Metrics report likewise highlighted the present pattern of miner capitulation. The crypto analytics company approximates that miners have actually cost least $500 million worth of Bitcoin up until now in June, diminishing their stockpiles by practically a 3rd.

The Bitcoin Hash Ribbons, an indication that determines the network's 30- day and 60- day hash rate moving averages, has likewise just recently turned to capitulation. This signals that miners are switching off their makers as it begins to cost more to run them than they can make back from block benefits.

When the Bitcoin hash rate declines, the network is configured to decrease the mining trouble. As problem modifications can just take place around every 2 weeks, it might be some time prior to the network can reach balance with miners once again. The last modification occurred on Jun. 22 and reduced problem by -2.35%.

At the very same time, the forced selling from mining companies might suppress any significant healing for the leading crypto property. When Bitcoin's rate sits listed below its typical production expense of around $30,00 0 per BTC, miners will continue to offer their reserves to survive. This might require miners to offer more Bitcoin to cover their expenses, reducing its cost, avoiding a healing, and trapping them in a vicious selling cycle.

Bitcoin will likely require a considerable bullish driver to break devoid of its existing depressed rate variety. Up until then, miners will need to wait and hope they can remain solvent enough time for a healing to happen.

Disclosure: At the time of composing this piece, the author owned ETH and a number of other cryptocurrencies.

The details on or accessed through this site is gotten from independent sources our company believe to be precise and trusted, however Decentral Media, Inc. makes no representation or guarantee regarding the timeliness, efficiency, or precision of any info on or accessed through this site. Decentral Media, Inc. is not a financial investment consultant. We do not offer individualized financial investment recommendations or other monetary recommendations. The details on this site goes through alter without notification. Some or all of the details on this site might end up being out-of-date, or it might be or end up being insufficient or incorrect. We may, however are not obliged to, upgrade any out-of-date, insufficient, or incorrect info.

You ought to never ever make a financial investment choice on an ICO, IEO, or other financial investment based upon the info on this site, and you ought to never ever translate or otherwise depend on any of the info on this site as financial investment suggestions. We highly advise that you speak with a certified financial investment consultant or other competent monetary expert if you are looking for financial investment suggestions on an ICO, IEO, or other financial investment. We do decline settlement in any type for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or products.

See complete terms

Bitcoin Miners Forced to Sell as Crypto Market Stagnates

The quantity of Bitcoin moved from mining business to crypto exchanges has actually struck its greatest levels given that February. Miners Under Pressure Bitcoin miners seem capitulating. Numerous metrics recommend ...

Dorsey, Saylor Defend Bitcoin Mining in Letter to EPA

An associate of Bitcoin market executives has actually refuted claims made by House Democrats contacting the Environmental Protection Agency to examine the ecological impacts of crypto mining. Bitcoin Industry Challenges ...

Tesla, Block, Blockstream Link Up for Solar Bitcoin Mining

Tesla likewise holds Bitcoin on its balance sheet. Tesla to Power Solar Bitcoin Mining Unit Block and Blockstream will start mining Bitcoin from a center that utilizes Tesla's solar power ...

Read More https://bitcofun.com/bitcoin-struggles-to-rebound-as-miner-capitulation-continues/?feed_id=26507&_unique_id=62bf5346787e4

No comments:

Post a Comment